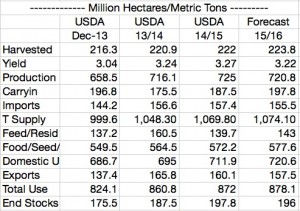

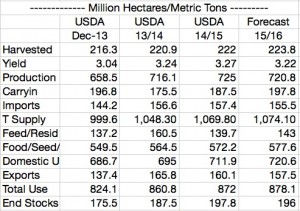

Initial 2015/16 wheat SnD’s in major producing, exporting and importing countries and the combined world balance sheet are displayed in the following table:

World wheat supply/demand balance

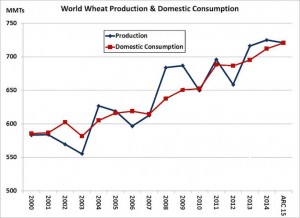

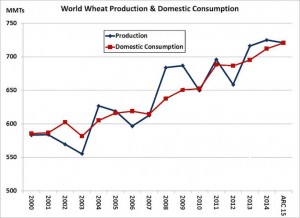

Assuming a slight boost in world acreage and near trend yields, production is expected to fall modestly to 720 million mt in 2015. This is still the second largest crop on record. Assuming domestic wheat consumption grows by 1% (vs. 2% in 2014/15), world wheat stocks are projected broadly unchanged in 2015. We reiterate that the US and world wheat markets lack a compelling story without adverse weather this spring and summer. Of note, N African and Mid-East production is projected to increase 1.7 million mt (20%) this year, with harvest to begin in the coming weeks.

Projections show total world production to exceed domestic use (albeit slightly) for a third consecutive year, as supplies continue to rebound from the substantial drop in stocks in 2012. World climate outlooks, which were updated last week, do not include any major abnormalities in the next three months. There’s been some talk of winterkill damage across the Black Sea, but we view this as overdone. Precipitation across Europe, Ukraine, Russia and China has been 70-150% of normal over the last 60 days. Temperatures have been within 1-4 degrees of average, mostly on the warm side and major production shortfalls across the Black Sea have historically occurred during the summer months, and center on Central and far Eastern crop areas of Russia.

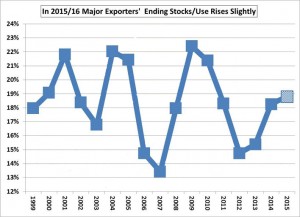

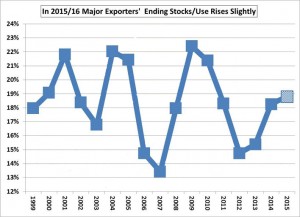

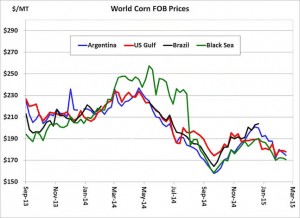

US and world wheat prices are determined in the export market, and the central theme of the 2015 crop year is a slight boost in surpluses in major exporting countries. Projected combined production in the US, Argentina, Australia, Canada, Europe and Black Sea at 387 million mt is down 2 million mt from 14/15. However, carryover stocks will be 12 million mt higher than the previous year, which will allow the Black Sea, in particular, to dominate world trade in Sep-Nov. Major exporters’ stocks are projected at 75 million mt, up 3 million mt on last year and the highest since 2010. Exacerbating this competition for world market share will be the dramatic change in currency relationships in the last 6 months. The wheat market will be the most affected by multi-year highs in the US dollar. The world wheat balance sheet will be little changed in 2015, but prices are expected to weaken slightly as US exports are capped at 900-950 million bu.