Weekly CCI Analysis:

The CCI/CRB stabilised on the week with the US$ rising to a 13 year high against the Japanese Yen, while trading broadly sideways against the €uro and most other currencies. US Central Bank officials hinted at US rate normalisation later this year while the EU struggles to get a new Greece accord that would prevent default and their potential exodus from the community. If the US economy continues to gain traction, the US dollar/interest rates will both likely rise into yearend. The US June jobs report and China’s monthly PMI reading will hold great interest to traders this week. There are clear signs that the US economy is accelerating its growth rate while China’s economic outlook is slowing. Chinese real estate values are trying to stabilise, but future strong raw material demand is not foreseen. Our view on the CCI/CRB index remains bearish with intermediate lows expected by late summer/autumn.

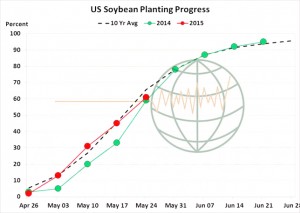

Longer-term soybean analysis:

CBOT soybean futures marked meager gains at the end of the holiday shortened trading week with support coming from a strong late week rally in soybean oil. The EPA released its proposal for the US biofuel mandates which triggered fund buying of soybean oil which pushed spot futures back towards the top of the recent trading range. Ultimately, the updated EPA requirements were a disappointment and came in below what many biofuel analysts had expected. Lawsuits could delay the implementation and palmoil producers are trying to have their vegoil become an advanced US biofuel participant. Late Friday, the Argentine oil workers union settled their strike and blockades at crush plants were removed. The port workers union is likely to do the same on Monday with a 27.8% wage increase. The majority of the US soybean crop is now seeded and the weather outlook into mid-June is favourable with regular rains/warmth. We hold to an outlook for steady/lower price trends into the summer, with November to test $8.40-8.60 for an intermediate low. Any rally to $9.20-9.30 basis November should be sold.

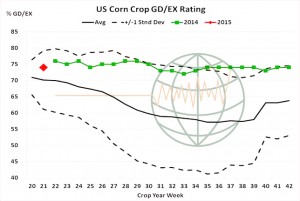

Longer-term corn analysis:

Corn futures ended down 9 cents, with July sitting just above its contract low posted during the 2014 harvest. NASS revealed the crop is rated at 74% good/excellent, a touch below trade expectations, but which our work suggests points toward excellent yield potential amid normal summer weather. Conditions are likely to improve in the coming weeks, as a warmer temperature pattern is established through the first half of June. Otherwise, as expected, the EPA has proposed substantially reducing mandated volumes for ethanol production/consumption. Nothing changes in the short run with ethanol supply/demand subject to market economics, but that the EPA has acknowledged the blend wall at 14.0 Bil Gal. New crop export interest remains meager. A more sideways pattern is expected in the next 3-4 weeks as the trade better assesses crop conditions and June/July weather forecasts, but should yield match last year harvest lows are pegged at $3.00- 3.20 basis Dec. We continue to be willing sellers of short covering rallies. More and more of the climate forecasting community are buying into a cool/wet Jun/Jul/August across the Midwest.

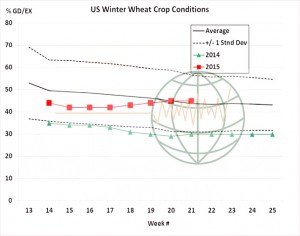

Longer-term wheat analysis:

World wheat futures ended sharply lower this week. Concerns over dryness in Russia and Canada have been mostly removed as rains have begun to fall across SE Russia and as forecasts into mid-June maintain near normal precipitation and temperatures. Egypt’s first purchases of the new international marketing year also validated Black Sea/E European cash prices at $190/MT, which is well below US Gulf offers. With forecasts improving, it’s back to attempting to boost US exports though Gulf premiums remain much too expensive. Our outlook is little changed, and ultimately world cash offers are projected to reach $170-175/MT by July. Russia looks to have a very marginal export tax beyond July 1 ($1/MT, with higher levels kicking in if world prices exceed $220). This is not expected to materially affect trade flows. We remain bearish and spot futures will likely range from $4.25-5.25 through the next six-nine months. How low prices reach depends on the value of the Ruble relative to the US dollar in July/August.