- The USDA has today released its weekly export figures as detailed below:

Wheat: 700,400 mt, which is above estimates of 400,000-600,000 mt.

Corn: 808,200 mt, which is above estimates of 350,000-800,000 mt.

Soybeans: 1,315,800 mt, which is above estimates of 800,000-1,100,000 mt.

Soybean Meal: 151,800 mt, which is within estimates of 50,000-200,000 mt.

Soybean Oil: 74,800 mt, which is above estimates of 10,000-55,000 mt.

- Brussels has issued weekly wheat export certificates amounting to 339,566 mt, which brings the season total to 1,655,262 mt. The season to date total is 807,738 mt (95.31%) ahead of last year.

- Today has seen a steadier market in Chicago with corn, wheat and soybeans all having traded in positive territory although the last hour of trade is beginning to show the grains easing back a touch to around unchanged. End user pricing ahead of the August delivery period in soybean and meal appears to have been the main soy complex driver today. Funds have made an effort at new longs, whether that is an attempt to justify some of their long and wrong positions remains to be seen.

- US export sales (see above) were somewhat better than expected, particularly in soybean and wheat, and this has lent some support to prices today. The figures included a net 15 million bu of old crop soybeans including a surprise 11 million bu to China, which is not expected to be shipped, and may indeed be an error according to some reports. New crop sales improved to 33 million bu. Wheat sales reached 25.7 million bu with renewed interest in hard red winter and spring grains. Old crop corn sales totalled 14.4 million bu with new crop reaching 17.5 million bu, neither figure being particularly inspiring! One thing remains abundantly clear, and that is that US new crop export sales are well below those of a year ago.

- In Europe, Matif wheat ended higher on a weaker €uro although cash premiums were pretty much unchanged. The EU export pace (see above) would suggest an annual figure in the region of 22 million mt, which is too low but overall demand (as we have stated ad nauseam) is clearly down at present. There will also likely be less for export based upon the suggested increase in feed wheat consumption. It seems that there is, and will be, more feed wheat supplies across the Ukraine to Bulgaria region than last year, and also more than originally anticipated. However, N France is without doubt experiencing a wheat protein deficit, and this may well find a feed home. Given last year’s EU corn crop plus imports of 85 million mt would result in a like for like import figure of 25 million mt basis the anticipated 60 million mt crop. To avoid a 25 million mt corn import figure it is becoming more and more likely that Europe will feed more wheat (and barley where possible) and reduce corn imports year on year. This will result in reduced EU wheat exports, and our current thinking is that we will see a figure closer to 25 million mt rather than the USDA’s current 31 million mt estimate.

CHINA IS SLOWING DOWN…..

- It’s an issue observers have talked about for years. But over the last week or so, it seems to have reached a tipping point – at least according to general consensus from a cacophony of commentators. China is slowing down. Its stock market has fallen sharply since mid-June and the government is panicking, leaping into action with a host of supportive measures like closing some share trading for upwards of 6 months.

- The Government halting trading is unprecedented, and would never occur in a more free market-oriented economy. Moreover, China has lowered its lending rate four times since the start of the year and cut their reserve requirements in an effort to boost the economy. Despite all the drama, the actual drop in the Shanghai composite does not have a significant wealth impact on all of China. Nevertheless, the concern is that near-emergency measures offered by the Chinese Government may be seen as a signal that the Government is no longer able to manage GDP growth. The concern is that Chinese debt has risen to unsustainable levels, offering new risk to China, which has been trying to shift its economy from one based on exports to one led by consumption.

- China has roughly had 1.3 billion people since they installed their “1 child policy” in the early 1970s. The world agricultural community has been counting on China’s huge population to be the saviour of agriculture. However, it was not until the early 2000′s that China became a WTO member and a significant importer of a host of commodities – including energy, ags and metals. This growth in Chinese import demand correlates with China’s rapid increase in GDP rates beginning in 2001/2002. When China’s GDP rates went from $1,000 per person to nearly $8,000 today, China’s demand for soybeans and a host of other commodities exploded. The question going forward is whether China’s soaring per-person GDP rates can be sustained for the next five years. This is the issue everyone involved with global commodity markets should be looking at very closely.

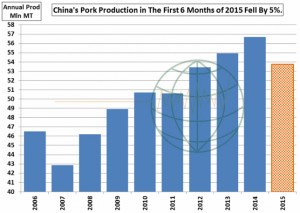

- The IMF, in its latest outlook, projects a decline in the rate of growth of China’s total GDP and in per-capita GDP in the coming years. Per-capita GDP is projected to increase 7.5% in 2015 and just over 6% in 2016. Growth will still occur, but this is notable change from annual boosts in income of 10-30% seen since the early 2000s. Declining marginal economic growth, coupled with farm policies that encourage production – but also imports – has triggered a huge surplus of commodities in China, most notably in wheat and feedgrains. Chinese corn and soymeal futures – solid agricultural indicators – have been in retreat in recent months, with corn having plunged some 20% since early May. China’s growing appetite for meat during its unprecedented rise has been a boon to global grain and oilseed markets, most notably soybeans. In recent years, strong Chinese import demand for soybeans has been the only thing (or certainly the main thing) supporting and driving prices higher. However, discouraging signals are starting to appear. According to the Chinese National Bureau of Statistics, pork production in the country fell by 5% in the first 6 months of 2015.

- The classic assertion that as per-capita income continues to grow (albeit at a slower pace) and more people come to urban areas, meat consumption will increase likely still holds true in the case of China. The 5% decrease in pork production perhaps clouds the larger picture, as some of the decrease can be attributed to natural losses in the pork sector and even a government-led crack down on the Chinese tradition of wasteful over-consumption at banquets. Pork prices have recovered recently, and we very well may see a recovery in pork production and consumption over the next 6 to 18 months. Still, the unsustainable growth of recent years, along with simply too much supply, has triggered questions surrounding China’s demand for raw materials over the next 1-2 years. One thesis since 2012 has been that adverse weather or much improved Chinese demand is needed to sustain any lasting agricultural commodity rally. Weather, of course, is unknown, but increasingly it looks like China will not be a driving factor in 2015 or 2016.