- Brussels has issued weekly wheat export certificates totalling 655,676 mt. This brings the season total to 9,064,414 mt, which is 2,482,607 mt (21.5%) behind last year. To reach the USDA’s latest EU wheat export total of 33.5 million mt it will be necessary for exports to hit an average of just over 740,000 mt for each of the remaining 33 weeks in the season.

- The USDA has today released its weekly export figures as detailed below:

Wheat: 721,900 mt, which is above estimates of 200,000-400,000 mt.

Corn: 779,800 mt, which is above estimates of 500,000-700,000 mt.

Soybeans: 1,798,100 mt, which is above estimates of 700,000-1,100,000 mt.

Soybean Meal: 247,300 mt, which is within estimates of 150,000-300,000 mt.

Soybean Oil: 37,700 mt, which is within estimates of 10,000-40,000 mt.

- In their latest update Stratégie Grains have raised their estimate for 2015 EU soft wheat exports to 26.8 million mt, an increase of 300,000 mt. At the same time wheat output is also increased by the same amount to 149.8 million mt, maize output is forecast 200,000 mt higher at 57.3 million mt whilst barley output remains unchanged at 60.5 million mt. Stratégie Grains views the pace of EU wheat exports as rising, particularly to N Africa in the light of a weaker €uro, which is improving competitiveness. At the same time domestic wheat consumption in livestock diets is reduced to 54.5 million mt vs. last month’s estimate of 56 million mt due to reduced competitiveness against other grains. Consumption by flour millers was also reduced by ½ million mt.

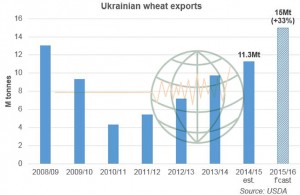

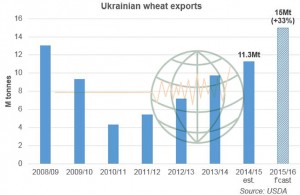

- Traders and the Ukrainian AgMin have agreed to limit wheat exports from the country to 16.6 million mt this season, according to reports by Reuters. However, the current size of the cap is unlikely to cause major concern as it is above both total season exports in recent years and current forecasts for 2015/16 exports (see chart below). This year, Ukraine has endured a difficult autumn planting campaign and concerns have been raised over the condition of crops for harvest 2016. As a result, the cap is expected to be reviewed in spring 2016 following an assessment of crop conditions. Current season exports from Ukraine have got off to a good start with 5.5 million mt of wheat shipped in the first three months of the 2015/16 season (Jul-Sep), according to data from UkrAgroConsult. This is 22% higher than the same period in 2014/15, while the USDA forecasts total season exports to be 33% higher year on year. Exports from Ukraine are usually weighted towards the front end of the season. On average, over the past five seasons, more than a third of the full season total was shipped by end-September, with an average of nearly 70% of the total exported by end-December.

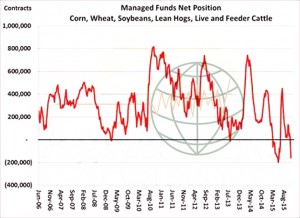

- It has been a mixed day in Chicago with a noticeably reduced appetite for selling in anticipation of Friday’s COT report showing an even larger net fund short position, which is offering some support (on the back of what would happen if funds cover their short). Added to this, larger than expected wheat, corn and soybean export sales bolstered further support as traders start to believe that current (low) prices are beginning to build and develop demand (we are not too sure on this one).

- S American corn fob premiums are starting to rise placing US Gulf offers at a slight advantage and interest is beginning to switch back to the US crop.

- Ultimately it is hard to remain overly bearish, despite the fundamentals, in the light of the sizeable fund short and multi-year low prices. That said, there is little on the horizon to suggest that there is anything of a lasting rally in the offing.