- Soybeans and corn pushed higher yesterday although closing well below the top of the range (uncertainty??) whereas wheat closed convincingly lower and this spilled into European prices as well. A weaker US$ and fund short covering added support to corn and beans whilst Black Sea and French cash wheat offers were still in decline as old crop stocks are looking for homes ahead of what could prove to be another record harvest. Abundant global wheat stocks remains the message.

- NOAA (The National Oceanic and Atmospheric Administration is an American scientific agency within the United States Department of Commerce focused on the conditions of the oceans and the atmosphere) released their latest long range forecast which calls for above normal precipitation across the Plains with cooler than normal temperatures into midsummer. The Midwest would see near normal rainfall with above normal temps from the N Plains through the Great Lakes. Near to above normal temperatures was suggested for the July/August period, but there was no mention of any lasting Midwest/Delta dryness. The forecast was seen as bearish for wheat with their April forecast calling for near to above normal rains and near below normal temps.

- The USDA has today released its weekly export figures as detailed below:

Wheat: 372,400 mt, which is within estimates of 350,000-550,000 mt.

Corn: 1,288,500 mt, which is above estimates of 700,000-1,250,000 mt.

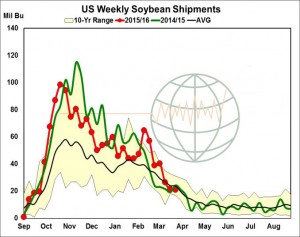

Soybeans: 858,800 mt, which is above estimates of 400,000-800,000 mt.

Soybean Meal: 83,500 mt, which is within estimates of 50,000-300,000 mt.

Soybean Oil: 17,500 mt, which is within estimates of 4,000-30,000 mt.

- Brussels has issued weekly wheat export certificates totalling 765,635 mt, which brings the season total to 21,452,755 mt. This is 1.92 million mt (11.55%) behind last year.

- Friday’s COT (Commitment of Traders) report will make interesting reading, to see by just how much the funds have changed positions, and also whether crude oil’s key price resistance at $40/barrel will hold or be breached – which will likely impact agri-commodities.