- The USDA has today released its weekly export figures as detailed below:

Wheat: 379,700 mt, which is below estimates of 400,000-600,000 mt.

Corn: 1,131,000 mt, which is within estimates of 900,000-1,250,000 mt.

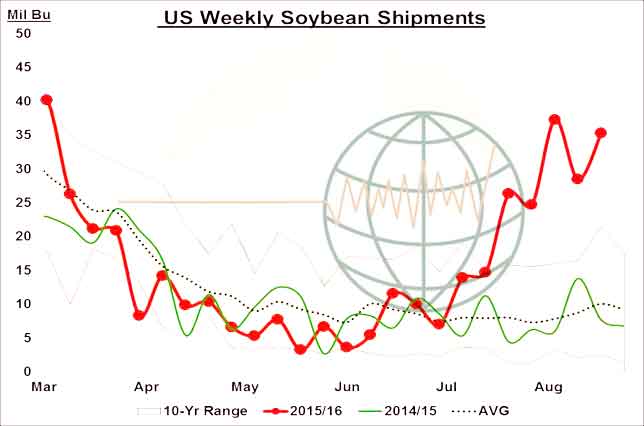

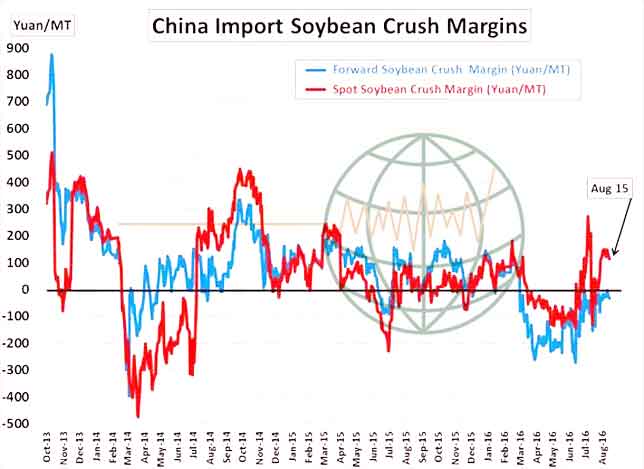

Soybeans: 2,054,700 mt, which is above estimates of 1,150,000-1,500,000 mt.

Soybean Meal: 213,800 mt, which is within estimates of 90,000-300,000 mt.

Soybean Oil: 3,700 mt, which is within estimates of zero-40,000 mt.

- Brussels has issued weekly wheat export certificates totalling 491,748 mt, which brings the season total to 4.372 million mt. This is 972,690 mt (28.6%) ahead of last year. Barley exports for the week reached 79,945 mt, which brings the season total to 974,983 mt, which is 1.4 million mt (59.0)% behind last year.

- Latest global crop estimate figures released today include SovEcon’s 2016 Russian grain output at 117 million mt, a month on month increase of 1.7 million. This includes 73 million mt of wheat, which accounted for the overall increase.

- The International Grains Council increased their 2016/17 global wheat output estimate to 743 million mt, a 8 million mt increase from last month. 2016/17 global corn was put at 1,030 million mt, 13 million above July and up from 969 million mt last year. Global soybean output for 2016/17 was also estimated higher than last year at 325 million mt, which is a 9 million mt increase. Of note was that US corn output was increased 14 million mt month on month to 379 million mt.

- News was received today that the Nord Cereals silo facility in Dunkirk, which is a delivery point for MATIF wheat, is to suspend deliveries as of Monday. No further information was given.

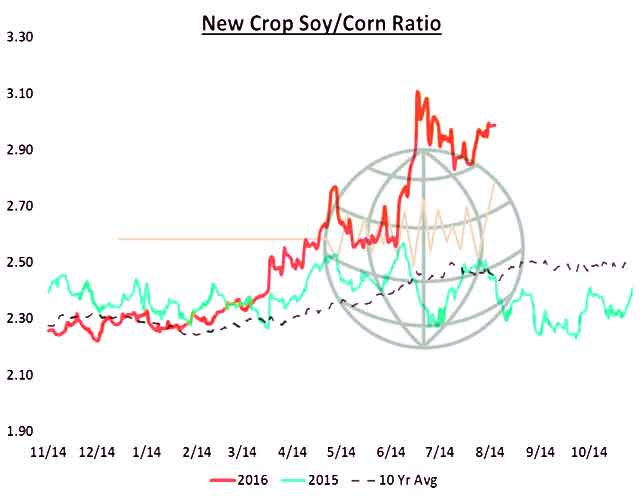

- Chicago markets have seen a “red” session so far today with soybeans pacing the way lower with the grains similarly easing. It seems that China has a limited desire to extend cover much further forward and the story swings from “big demand” back to “big supply” as we have suggested would be the case on m ore than one occasion in recent weeks.

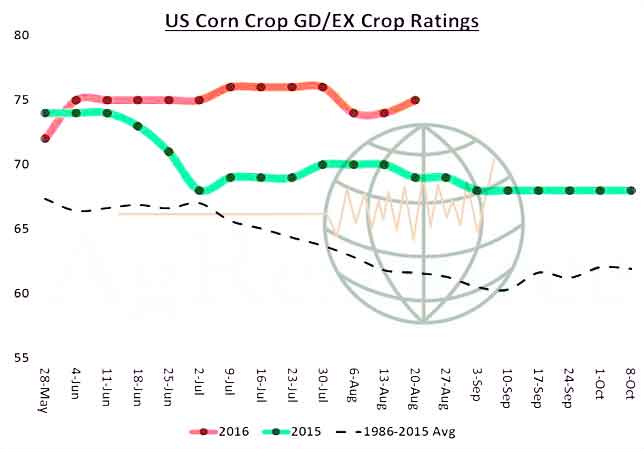

- The ProFarmer tour results continue to give potential for a modest hike in the next NASS yield report due for release in September whilst they currently validate a corn yield at/close to/just above 170 bushels/acre. Consequently we are unlikely to see any substantial downward adjustment in US corn supplies. US crop supplies remain in an upward trajectory and end users can see this, and are less inclined to follow or chase rallies right now. The final ProFarmer results will be available on Friday and we will update as and when we have the data.

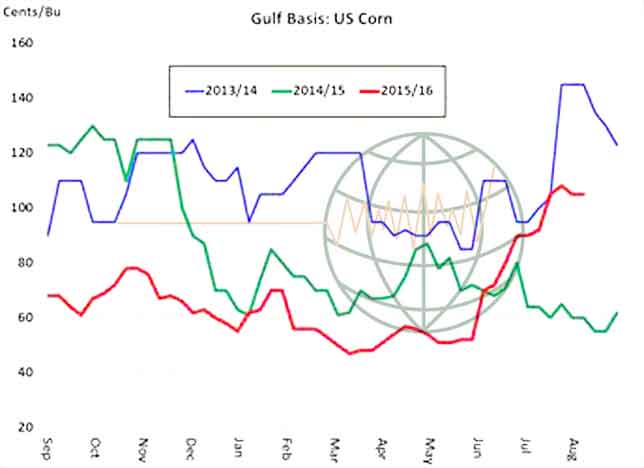

- It must not be forgotten that we are still in the month of August and right now it is supply ideas that are driving markets and prices, and likely to remain the case until early US harvest is well under way. With funds heavily short and US corn now globally competitive we see the global market building (albeit slowly) a sizeable demand base, which is likely to see downside potential limited.