- Today, which is the day of the BIG US vote, has seen Chicago markets surging higher with the funds emerging as big buyers and end users adding to coverage ahead of the election results as well as tomorrow’s USDA crop report. Soybean oil has led the way higher on the coattails of Malaysian palm oil, which overnight reached two year highs. Grains were the follower.

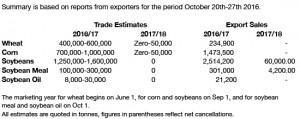

- The most common explanation for the Chicago rally is that everyone is bearish! Traders are wondering who will be the sellers following the USDA report with US producers nearly completed with their summer row crop harvest and US corn, soybean and wheat exports (shipments as well as commitments) well above last year. Our guess is that short covering precedes the USDA report, but that with S American weather largely favorable, it will be difficult to sustain a post report rally in Chicago futures.

- Since mid summer we have been outlining our expectations for a “big crop”, “big demand” marketplace with a seasonal rally high to be posted sometime between late October and mid November. Our thinking has not changed assuming normal S American weather. The point is that Chicago markets would be trading in a range with neither rallies or breaks being able to follow through in a generally range bound marketplace. January ’17 soybeans above $10.25 and December ’16 corn above $3.60 appears to us to be fundamentally unjustified at this time.

- Mato Grosso and much of the N Brazilian soybean crop has been planted at a record fast pace this year. This means that as much as 9-11 million mt of Brazilian soybeans could be harvested by mid February given normal weather conditions. This would potentially place Brazil as a much more aggressive and earlier soybean exporter than in previous years. Furthermore, this would allow Brazil a more lengthy window to seed their winter corn crop and for seasonal rains to fall. The outlook for Brazilian soybean and corn crops is improving amid the fast seeding pace and favourable weather pattern to date.