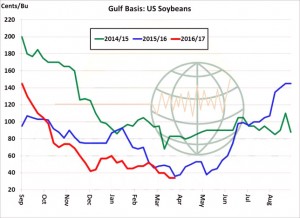

- US Gulf soybeans are now trading at their lowest levels in five years as competition between Brazil and the US heats up. The chart below reflects that US fob Gulf soybeans are offered at $.31/bu (basis) for April as the US tries to encourage some additional export demand. US farmers have reportedly sold large amounts of their old crop holdings on the prospect of record large S American production. Yet seasonally, a bottom on Gulf basis soybean bids often occurs in the next 2-6 weeks as stocks tighten. US farmers are likely to slow their cash sales on seeding and awaiting summer weather trends.

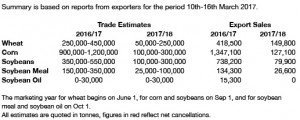

- Chicago markets have been lower once again today, and slower in terms of trade volume with weaker global markets and favourable weather (or benign if one prefers) patterns. US weekly export sales and a recovering crude oil were unable to counter the decline. US export data showed soybean sales better than estimated, corn at the lower end of expectation and wheat in line with expectations despite US Gulf prices attaining discount status to all other origins.

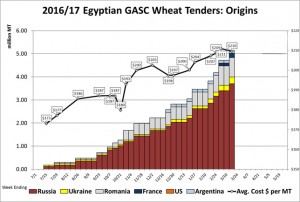

- This week has seen crude oil prices rally, and this has assisted the Russian Ruble hit 20 month highs. Russian wheat replacement prices in S Russia (where export volumes are sourced) are only just below current fob levels and it seems that their prices are unlikely to relax significantly in the next few months. Meanwhile EU cash prices continue to drift lower. The favourable weather conditions in US and S America is well known and reported but the main forecasting models have recently trended wetter across C Europe and Black Sea. Given tis and normal to above normal temperatures will leave early season crop conditions above average. It remains too early to suggest above trend yield for N European wheat crops but there remains no evidence of a weather threat in the near term. With corn and wheat both competing in the feed markets and trying to secure marginal demand gains the overall feed grain market continues to lack the necessary spark which could trigger higher levels.

- We see prices currently leaving us with a more neutral view on things, additional downside will require some bearish input from tomorrow’s report or further significant erosion in S American cash markets.