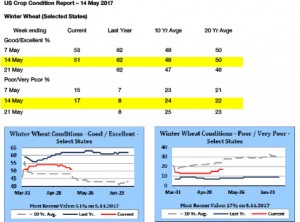

- US winter wheat crop condition data has been released as follows:

- We have seen another day of mixed trade in Chicago with soybeans trading higher and the grains, corn and wheat barely changed. Improved US old crop soybean export prospects have been cited as the driver for today’s price action in soybeans.

- It would be “normal” at this time of year for volume and/or market activity levels to be high based upon yield risks as we approach the summer period. However, it seems that these risks are not building, indeed they appear to be receding, and the only selling is coming from stale longs in Kansas wheat, which funds are shedding.

- US corn planting is mostly on a timely basis, the key issue being just how much needs to be replanted due to wet conditions and/or flooding. Soybeans have a better ability to make up for early poor establishment, and are thus differentiated from corn. The question today is whether corn can grow out of its ugliness, and this will be watched closely in the next few weeks.

- Below to much below normal temperatures will prevail across central US regions for the next few weeks. A peak in temperaturess will be seen in the next 36 hours with a decline thereafter. The cool to cold and wet Plains weather will add to the disease pressure in winter wheat. Soybeans have an export demand story for now with the US making new sales to China in July and August. At some point, and before too long, corn will need more warmth for growth.