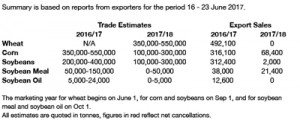

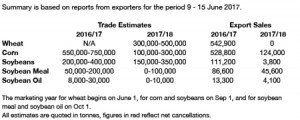

- The much awaited USDA June Stocks and Seeding report offered some mixed results but the market generally took its contents as bullish amid ongoing threats of warm and dry conditions across the Plains and north western Midwest. Chicago wheat, corn and soybeans are sharply higher again.

- US 2017 cropped acres as estimated by NASS equaled 318,184 million acres, down 1,058 million from the prior year. Total US cropped acres confirmed that US farmers seeded all available acres despite low prices and profitability. Historically, the US Government has to pay farmers to set aside acres, or severe flooding must occur to cut back on US seeded acres. The USDA reported 2017 US corn seeding at 90.9 million acres, up 890,000 acres from the March estimate, but down 3.118 million from last year. The cool/wet spring across the Central & Eastern Midwest did not have any adverse impact on total US corn seeding. US corn harvested acres was pegged at 83.5 million acres, which along with trend yield of 170.7 bushels/acre would produce a 14,187 million bu crop. The biggest corn seeding shortfall occurred in IL at 500,000 acres while combined corn seedings in IN/OH were off just 150,000 acres. Note that N Dakota corn seeding rose 250,000 acres to 3.7 million. Total US Dakota corn seeding was estimated at 8.9 million acres representing 6.6% of US corn production.

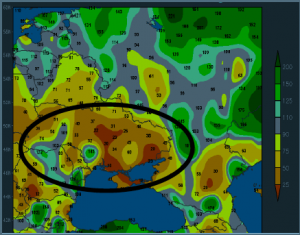

- US 2017 soybean seeding was estimated at 89.5 million acres, virtually unchanged from the March estimate, but up 7.3% from last year to a new record. The states posting the biggest seeding gains were MN with acres up 650,000 acres to 8.2 million acres and N Dakota with soybean seeding up 1.15 million acres to 7,200 million. We would also note that S Dakota soybean seeding was up 200,000 acres to 5.4 million acres. The drought area of the Dakotas has 12.6 million acres of soybeans or 14% of US production. By seeding, N Dakota is the US’s 4th largest soy state!

- US 2017 all wheat seeding fell to 45.7 million acres, the lowest US total since USDA started keeping records back to 1919. US winter wheat acres held steady from the March report while spring acres fell another 330,000 acres to 10.9 million acres. US durum wheat seeding was also lower and there are supply bull stories in both HRS and durum wheat going forward. We note that US HRS harvested acres are likely to decline further in future reports depending on weather conditions. The marketplace will need to secure additional US spring wheat area in 2018 which will likely curtail US corn and soybean area.

- US corn stocks as of June 1st were 5,225 million bu, up 514 million from last year and a record. Third quarter US corn use was estimated at 3,400 million bu, up 290 million The June 1st US corn stocks total was above the average trade estimate and considered slightly bearish. The third quarter feed/residual use estimate is estimated 978 million bu, up 54 million. We do not expect WASDE to alter their annual US corn feed/residual use rate in the July reports.

- US June 1st wheat stocks were estimated at 1,184 million bu, the high end of trade estimates and up 208 million bu from last year. Fourth quarter feed/residual is calculated at a -57 million bu which compares to -37 million bu in the year before. June 1st wheat stocks define totals for the 2016/17 crop year.

- US June 1st soybean stocks were 963 million bu, down 20 million from trade estimates, but 91 million above last year. Third quarter US soybean use was record large based on strong US export demand.

- It would be virtually impossible to advise a bearish stance right now as less than favourable weather moves into the central US and with drought across the N Plains looking likely to expand both south and east into the second half of July.