To download our weekly update as a PDF file please click on the link below:

Monthly Archives: June 2017

15 June 2017

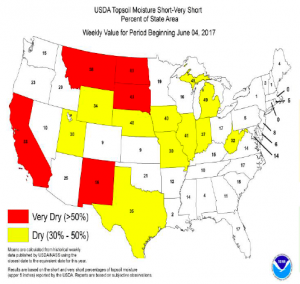

- Wide swaths of the Midwest are suffering from short to very short soil moisture. The latest NASS report confirmed that 52 million corn and soybean acres are short or very short of topsoil moisture, and subsoil moisture is also in fast retreat as three weeks of drier than normal weather has occurred. Drought, by definition, is measured by an extended period of below normal precipitation. You do not need soaring temperatures to produce drought, just below normal rains. Yet to be determined is whether the drought in the N Plains will expand south and east. It would be historically unusual if the ongoing dryness did not worsen and expand during mid to late summer.

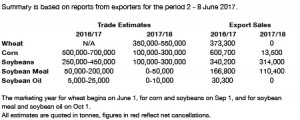

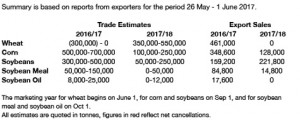

- US export data has been released as follows:

- Chicago markets started the day mixed but have moved into positive territory with wheat leading by some margin. Th market continues to await weather forecasts and the anticipated arrival of hot and dry conditions, the real questions are “if” and “when”.

14 June 2017

- Lower volumes and prices has been the order of the day in Chicago today, and this has translated into London and Paris wheat markets too. Crude oil values easing to below $45 has placed a cap on prices and the early rally stalled. Expectations of the US Federal Reserve raising rates a quarter point later in the day has helped the US$ and again helped cap commodity price upside.

- Weather models have some agreement with returning heat and dryness in the last week of the month, and this has the potential to push prices higher as and when there is confidence in the forecast. Some US farmer reports are showing corn stress levels rising in hot, dry and windy conditions. Leaf rolling in the afternoon and unfurling at night is reported to be farly common right now.

- The wet and cool spring weather conditions followed by heat and dryness in late May and June make it look unlikely for corn to reach trendline yields in 2017. Soils have dried to hard pans in Central US and replanted corn has struggled to emerge or regrow, shorter plants with reduced potential appears to be the most likely outcome. Whilst this is not the case across the whole corn belt, it is being reported quite widely. Yields of 171 bushels/acre require the crop to have good conditions, this year has already seen a number of “bad” days and the question right now is how many more “bad” days is the crop going to endure?

- Clearly it is tough to trade weather markets when the weather models are in full agreement, but when there are divergences such as we are seeing at present it becomes doubly or trebly difficult. The current price break, albeit small, does not encourage us to become bearish and we prefer to see it as a buying opportunity rather than joining in with the sellers.

13 June 2017

- US crop condition data has been released as follows:

- Key in the data above is that US spring wheat condition is at its lowest level in nearly 30 years. Only 46% of the crop is rated good/excellent as shown above, a 10% reduction week on week. The rating reduction was greater than trade expectation and created a stir in the market place with prices spiking sharply higher. Higher protein wheats, particularly in the US, are under a greater degree of pressure, and that appears to be translating into other origins, and will likely weigh on other wheat grades too in the fullness of time.

- Tuesday saw soybeans trade an “inside day” leaving both old and new crop contracts about unchanged, but well below early session highs. Weather forecasts continue to hold the attention of the trade with current dryness directly opposed to the wetter forecast, which has rainfall across the entire cornbelt in the latter part of the week.

- Corn futures followed wheat to a modestly higher close with the main issue not so much near term rain but more “what is the trend next week and beyond”. There is an expectation for improved soil moisture levels in the coming week but the six week outlook is key and whether drought expands or declines in that period will be a determining factor in price direction. There is talk around that China will eliminate its value added tax on DDG imports but there remains anti-dumping and anti-subsidy tariffs that will hamper any major DDG import in the near term. It is the longer term policy that will be of interest.

- Wheat, as mentioned above, rallied strongly as the market digested the latest crop ratings, particularly the spring crop. The Dakotas received decent rains in the last day or so but it seems spring wheat development, particularly in SD has gone beyond the point of recovery, and warm/dry conditions look set to return there before long. The outlook for the SD crop is not good. Winter wheat markets followed as did fob offers in Black Sea and Europe.

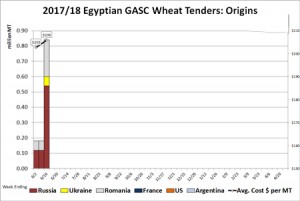

- Egypt’s GASC secured another purchase this week, the second, in which Russia, Romania and Ukraine were the selected origins. The latest price paid was a shade lower than the last tender at the weekend, at $193.50 basis fob, but includes (we believe) a modest premium on account of the current zero tolerance policy on ergot contamination. We would mention that Egypt secured wheat in early July a year ago at $163/mt, basis fob, and though that was more of a harvest position, world cash markets now hold a slight premium to year ago levels. This is especially true in N Europe. Without a major and rapid change in spring wheat crop conditions, work suggest a yield of 37-39 bushels/acre, which in turn makes the HRS balance sheet untenably tight. US HRW wheat end stocks could tighten to 360-380 million bu or 200 million less than 2016/17. Early seasonal lows appear to have been forged.

12 June 2017

- Egypt’s GASC made a 360,000 mt purchase of wheat over the weekend with prices up $3/mt from their first tender of the season reflecting a general increase in global prices. Romania and `Russia were once again the awardees in this latest tender. Some feel that the price paid reflected something of a premium as a consequence of zero tolerance on ergot contamination – once again.

- Chicago markets have seen some decline today as forecast rainfall and its impact upon new crop corn and soybeans weighs on traders minds. Farmer selling has declined, perhaps as a result of declining crop condition. Fund managers are seeing prices fall back to last week’s breakout levels and a “Turnaround Tuesday” looks on the cards tomorrow. Historically dry conditions in the first half of June leave crops requiring abundant rainfall in the latter half of the month.

- Our view is that weather concerns are not yet over and that we will see further weather driven price rallies before this growing season is done and dusted. Trendline yields, particularly in corn, and also in US wheat, look ambitious at this time.

9 June 2017

Our weekly fund position charts can be downloaded by clicking on the link below:

To download our contemplations on the latest USDA report as a PDF file please click on the link below:

8 June 2017

- US export data has been released as follows:

- The current price rally has seen some huge cash corn sales by US farmers who are happy to part with stored stocks, and cash basis has declined as the market takes on board test additional supplies and end users as well as exporters add to their forward coverage. The market awaits the potential for new crop supplies and we would suspect that cash basis could weaken further as S America takes over export demand from the US beyond July.

- Chicago markets have extended the overnight rally with spring wheat leading the charge. Front month (July ’17) corn futures are flirting with $3.90/bu technical resistance whilst wheat futures break through, which is triggering further fund short covering. The midday weather model is little changed from this morning, though the GFS continues to fail to bring meaningful rainfall forward in time. The EU model in recent days has maintained near complete dryness throughout the next ten days, and in the short term the burden of proof is on the bears.

- It feels as if funds will continue to short cover and/or buy until such time as we see improved US weather conditions actually materialise.

7 June 2017

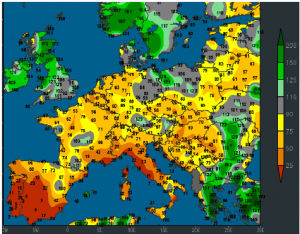

- Although rainfall returned to much of Europe in late May and early June, a below normal rainfall pattern is anticipated going forward with warm to hot temperatures. June is the key month to determine wheat yield and production, and the latest weather forecast hints at declining crop prospects across much of the continent and throughout Ukraine. The 2017/2018 world wheat crop is in decline, which is in stark contrast to a year ago when world yields gained amid favourable weather conditions.

- Spot (July ’17) Chicago corn futures have pushed higher and breached technical resistance at $3.805, which triggered further widespread fund short covering and further price upside.Corn traded volumes have exploded as weekly charts break out to the upside. Wheat and soybeans have followed corn’s bullish lead as Kansas wheat futures lead the way as yield data continues to disappoint as the harvest pushes north. Soybean prices have held back a touch as weakness in the oil portion of the crush limits upside somewhat. We would expect to see a retest of the $9.40-$9.50 level before the weekend basis July ’17 futures.

- It feels as if all Chicago futures markets are adding weather premium right now in advance of anticipated hot, dry and windy forecasts. There is a projection for “blast furnace” like conditions, which will take a toll on central US crops if it materialises.

- Market volumes have been huge today, and this is one potential sign of changing direction – recall our earlier suggestions that we may have seen a market “bottom” – and today could well be another signal that this is under way. Friday’s report continues to loom large over the market but again it is the forecast hot and dry weather that is holding centre stage.

6 June 2017

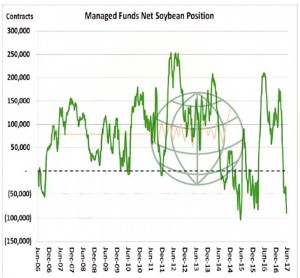

- Funds are back to holding a near record short soybean position that is not going unnoticed. The chart reflects funds holding a sizeable net short position heading into the heart of the growing season. Whether a stout rally develops is in the hand of Mother Nature, but history shows it not unusual to have a few good weather scare rallies during a growing season. We also note that with US and world farmer selling limited by the weak price structure, funds will have to maintain a brisk sales pace to keep the soybean complex under pressure.

- US crop condition has been reported as follows:

- July ’17 wheat futures in Minneapolis have reached two year highs leaving the Chicago bears somewhat more nervous than has previously been the case, and some short covering has been the case. Soybeans continue to attempt to carve out a bottom in the market but the question of whether or not the current warm and dry spell is impacting the soybean crop is leaving many guessing. Consequently, soybeans are following the grains rather than forging their own price path. Kansas wheat has moved strongly above its 50 day moving average and closes above this level will likely trigger fresh fund buying when the market opens. It feels very much as if we have seen the seasonal low in wheat and that the market is awaiting further confirmation of likely 2017 US and world crop reduction prospects. The corn market is also higher, forming a bullish reversal pattern with today’s prices taking out yesterday’s high and low.The market is adding weather premium on drier trends.

- Heavy fund shorts and a twitchy, nervous feel to the markets as warmer and drier conditions appear more established across the Midwest and C Plains leave us somewhat more friendly to the market. Yesterday’s improvement in corn crop rating (see above) is not having a bearish impact as focus is more upon future condition deterioration as soil moisture levels decline. Friday’s USDA report looms close but it is the hot and dry central US forecast that is grabbing the headlines.

5 June 2017

- Trading in Chicago at the start of the week has been mixed with limited direction. It seems that traders are awaiting more clarification on where central US weather patterns are going before committing to fresh positions. Of note was the continued increase seen in Minneapolis wheat premiums relative to other grades. US farmer cash selling of corn and soybeans is slowing quickly as they consider the change in growing conditions from cool and wet to warm and dry. An unusual pace of drying soils and hardpan formation on the back of “ponding” following spring rains has led to some increased concern over corn and soybean crops’ ability to root down unless normal, or near normal, rainfall returns, and soon. That said, the funds remain resolute in their massive net short positions, and technical chart patterns leave little near term indication that corn or wheat are about to break from current trading ranges. Meanwhile soybeans and soybean meal charts remain in technical downtrends.

- Funds holding net short positions may well be starting to be getting somewhat impatient that profits are not rolling in particularly as we are about to see the release of the June USDA report on Friday this week. Weather forecast models for the coming week or two hold limited agreement and are therefore somewhat less reliable. The UK general election outcome will doubtless play a major role in the future direction of £Stg and UK equity markets. How the week develops will be interesting to watch.