- Friday’s CoT report did not reflect the needed liquidation to suggest that the downside price risk has been curtailed in grains, soybeans or livestock. The data reflected that fund managers did not react to sliding prices and the early week prospect of improved Central US rainfall. Funds are holding their largest combined net long ago position since late 2016. We would argue that if there is liquidation prior to the August crop report, it will come in corn, soybeans and potentially hogs. Friday’s CoT data is slightly bearish to start the new week.

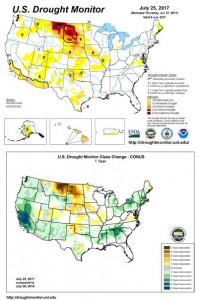

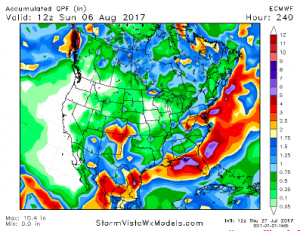

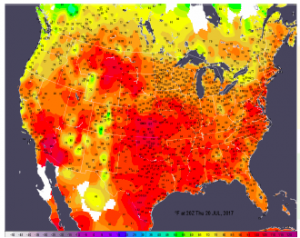

- The major forecasting models are little changed from Thursday’s and this morning’s runs and still indicate that a high pressure ridge will dominate the N American pattern into the middle part of August. As of earlier this week, some 3-9” of rain was needed to ease drought in the Dakotas, NE, IA and S IL. Such rainfall certainly won’t develop in the next 8-10 days, and the lack of moisture will keep crop concern elevated. A broad NW upper air flow is forecast over the next 10 days. Cooler temperatures lie in the offing, but Gulf moisture will remain closed to remainder of the Central US, and so very little rain is expected in the near/medium term. This week’s spotty rainfall was welcomed, but a trend of rapidly declining soil moisture has returned. The GFS’s implied soil moisture change is offered.

- This pattern looks to remain stagnant into Aug 11th as high pressure ridging again expands in the 11-15 day period. A moderate warming of temperature is indicated, but most important is that the mean position of the jet stream will stay north and east of major producing areas, keeping heavy rainfall isolated to the mid- Atlantic and New England. There’s time for soybean yield potential to recover, but as of now guidance on August precipitation suggests a continued lack of meaningful rainfall, particularly where drought is already established. We maintain that a major tropical storm is needed to change the overall US pattern, but such a storm is not projected in the next two weeks. Crop conditions, which tend to decline seasonally likely will be slightly lower in each of the next two weeks.

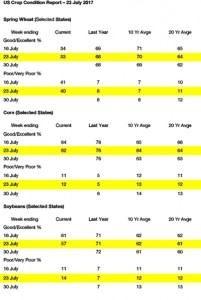

- Soybeans extended late week gains to finish the week 5-6 cents higher. Weather forecasts remain warm/dry which offered early support, while court ruling against the EPA’s 2016 biofuel standards sent the soybeanoil market sharply higher. In 2016, the EPA lowered the amount of biofuels need to be blended into the US fuel supply based on consumer demand. The e court ruled that this should not be allowed. This week’s Midwest rains fell across the areas that were largely well watered, and avoided the areas that are parched. Based on the large parts of IA and the N Plains that saw limited rains, we expect another 1-2% decline in soybean good/excellent crop ratings on Monday. The GFS weather model at midday maintained limited rainfall across the Midwest in either the 5 or 10 day outlooks for the driest parts of W Midwest and Plains states. The Commitment of Traders update showed funds added 12,534 contracts to their long soybean position and are long 50,885. It is going to be a wide ranging market into the August crop report, with limited rains in the forecast to support any break.

- September corn ended exactly unchanged, and despite funds still holding a net long position, as of Tuesday worth 106,815 contracts, the US forecast is simply too dry to sustain any lasting bearish trend. US corn crop conditions on Monday are expected to fall another 1-2%, and each decline in ratings suggests a further decline in yield. Recall good/excellent ratings a year ago stayed at a lofty 74-75% throughout all of August. The EPA’s court loss today implies little for future ethanol production and demand. Retroactive credits may be given to refiners for 2015 and 2016, but otherwise ethanol remains subject to market forces. We mention that amid falling US stocks of crude/gasoline, biofuel blending margins are rallying. Regardless of any appeal, the US ethanol market will remain strong, particularly as modest export demand continues. We maintain that harvest lows this autumn will stay at/above $3.50 spot futures and corn’s upside is current pegged at $4.10-4.20. The S American cash market is forming its seasonal bottom, and US yield loss will have a major impact on the major exporter balance sheet going forward.

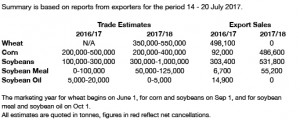

- Like corn, world wheat weather is just a bit too adverse to allow for a sustained bear trend to emerge. Another round of heavy showers will impact parts of Germany and Poland next week, and there is no end in sight to heat and dryness across the Canadian Prairies. Canada’s yield is still being affected. We would mention that, despite harvesting what looks to be a record winter crop, interior and fob cash markets in Russia remain firm. Domestic values this week are unchanged in both Ruble and US$ terms, and currently rest $10-12/mt above the same week in 2016. Black Sea/EU hi-protein fob offers end the week at/above $200/mt for Sep/Oct delivery, vs. comparable Gulf HRW at $198-200. Russian domestic values are expected to find a bottom in the next 2- 3 weeks, and so there is little evidence to suggest a collapse in world wheat prices lies in the offing. Funds are still net long (heavily so in Kansas), but the decline in major exporter stocks in 2017/18 suggests this position is validated.

- Our weekly fund position charts can be downloaded by clicking on the link below:

Fund positions disaggregated data