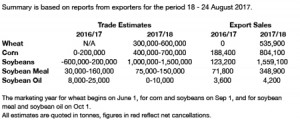

- US export data has been released as follows:

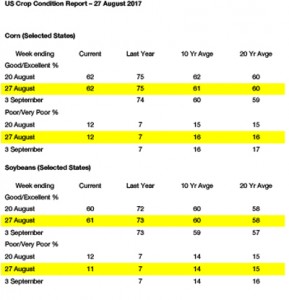

- Almost like clockwork we have seen Chicago markets in grains and soybeans post a strong recovery as producer liquidation of cash stocks and September futures contracts came to an end. A push lower for December corn triggered fund short covering as well as fresh buying. By midday December corn had traded through a full nine cent range with some 190,000 contracts changing hands. November soybean futures caught the support and made ten cent gains in strong volumes. Our feeling is that, just like last year, season lows are being or have been set. However, the strength of any rally will depend upon harvest yield data as well as Chinese buying demand.

- The StatsCan August update held few bearish surprises and was thus viewed as supportive. The 2017 Canadian wheat crop was estimated at 25.5 million mt, 20% below the 2016 crop and slightly below trade expectations. Canola output at 18.2 million mt is down 7% from last year and under average expectations of 18.6 million mt. Stock estimates will follow next week but the Canadian canola market appears ready for action going forward; a combination of tight old crop stocks and reduced new crop supplies would suggest a demand rationing price rally is in the offing.

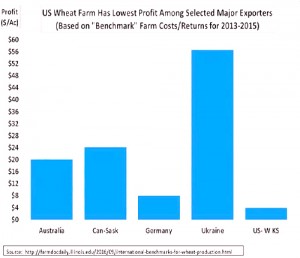

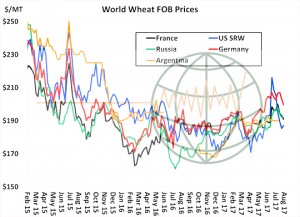

- Australian reports of frost/freeze damage are growing as another hard freeze impacted New South Wales and Victoria overnight. There have been four hard freezes that is catching a wheat crop in the boot and late boot phase. It will take time to make a better assessment of the crop impact, but the forecast remains cool to cold with limited rain for another two weeks. This late winter weather pattern does not appear to be changing.

- Chicago markets have become technically very oversold and have bounced from what we expect to be seasonal lows. Corn and soybeans are pacing the rally while spot month liquidation in Minneapolis wheat futures is holding back Chicago and Kansas wheat values at present. The Midwest dryness will trim yield potential, and our bet is that a bullish surprsie could be offered in the September report.