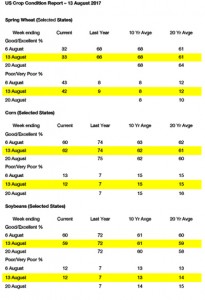

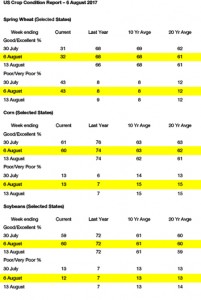

- US crop condition was released after the close as follows:

- Soybeans slipped to new lows in early Monday trading and were mostly 5-7 cents lower at the close, but near the highs of the day at the close, while August soybeans were off 10 cents for the day at contract expiration. After the close, NASS reported that 59% of the soybean crop was rated as either good or excellent versus 60% a week ago. Good/excellent ratings increased in 8 states, declined in 7 and were unchanged in 3. The largest increase for the week was in ND (+7 to 44%), and the largest decline was in MI (-7 to 55%). NASS reported that 94% of the crop was blooming versus the 5-year average of 93%, while 79% of the crop was setting pods, ahead of the 5-year average of 75%. Soybeans are now very oversold, with limited confidence in the USDA’s August yield estimates. We expect the market to turn range bound from $9.20-9.60 ahead of next week’s Pro Farmer Crop Tour.

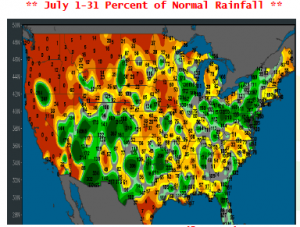

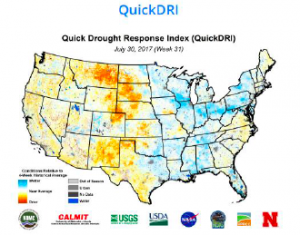

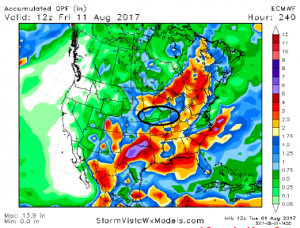

- Chicago corn futures spent a majority of the session in the red, only to end slightly higher by the close. Dec continues to hold major chart-based support, and still there are many questions surrounding US yield potential. Much better rainfall lies in the offing across the Plains and W Midwest, but will it fall in time is the big question. Work continues to suggest that neither the bulls nor bears will be able to sustain much momentum until combine data is available sometime in early Sep. Good/excellent ratings this week improved 2% to 62%, vs. 74% on this week a year ago. Major boosts are noted in CO, TX, NE, IL and IN, which more than offset somewhat surprising declines in KY and MI. IA ratings are down another 3% to 61% (vs. 83% a year ago). This week’s numbers indicate recent rainfall has stabilised yield potential nationally, which at the least will fuel debate on whether yield is closer to 164 or 169. Only harvest data will provide any real clarity.

- Black Sea harvest data continues to suggest that Russia’s crop may still be understated by 1-2 million mt, though Russia’s exportable capacity will go unchanged. We also mention that hi-pro milling wheat in Russia has fallen only slightly and comparable Gulf HRW maintains a slight discount to Russia, as well as all other origins. The world market has been inundated with this year’s N Hemisphere winter wheat harvest, but US wheat is viewed as cheap at current prices, which are only modestly above this week a year ago. Breaking news is largely absent. US spring wheat ratings were pegged at 33% good/excellent, vs. 32% last week, but harvest is now 40% complete and what is done is done. NASS’s production forecast is still overstated some 20-30 million bu in our view, which is entirely a function of abandonment. We continue to remain concerned about production in Australia and Canada, and consequently Canada’s ability to ship more wheat to the US.