- Ag markets are steady to weaker at midday, with wheat leading the way down on long profit taking. Corn and soy futures today have found new 4 or 5-month lows, while July Chicago wheat rallied 30 cents in the first week of June. We expect this evening’s CFTC report to include a very modest net managed fund long in Chicago wheat. On the week, July corn is down 14 cents, wheat is down 5, with beans down 51. Otherwise, it is still all weather and global trade. Radar maps at midday show moderate rainfall working across northern IA, WI and northern IL. These areas have seen rainfall so far in late spring, but it is likely that some of the driest areas of IL get a boost in moisture in the next 72 hours. The GFS maintains widespread shower activity across the Corn Belt into next Mon/Tues. The G7 meeting in Quebec will be ongoing today. NAFTA discussions will be separate from this, but rhetoric remains of escalating tensions between the US and others. The US$ has maintained its overnight strength. Other macro market are little changed from earlier in the morning, with crude down $.40 and equity markets unchanged.

- The Brazilian Real is sharply higher this morning as the country’s Central Bank pledges to do all it can to fight inflation and ongoing currency weakness. Another $20 billion will be used to strengthen the Real by the end of next week. Contacts suggest this is true, but whether the efforts are sustainable is less certain. Interest rates cannot be raised amid economic contraction. On the margin in the last 2-3 months, currency action indicates a boost in non-US acreage in 2019.

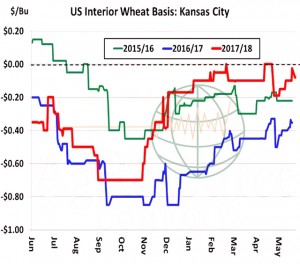

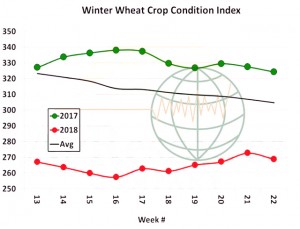

- This week’s Plains HRW harvest report indicates protein levels are rather higher (not surprisingly given recent heat/dryness), but that NASS’s first yield estimate in OK is accurate. Harvest has started in KS, and amid lower planted acres should be move quickly. Abandonment needs close watching. Russian cash wheat prices end the week unchanged from recent days, but a touch higher on the week. There is quite a spread developing between world exporters. Russian fob is offered at $205/mt for August. Gulf HRW is offered at $240, with Australia at $260 and Argentina at $285/mt. With Russian dryness ongoing, and as it is the world’s cheapest origin (by far), we expect Russian wheat prices to form a bottom in the next 1-2 weeks.

- The midday GFS weather forecast is wetter in Central Ukraine, but maintains complete dryness across the whole of Russia’s wheat/corn belt into June 20. The corn market will pay much more attention to Black Sea dryness if it continues into the early part of July.

- The midday GFS North American weather pattern forecast is cooler and slightly drier for the N and W Midwest over the next ten days. The mean position of the high pressure ridge is farther south and less amplified. Rains will fall across the western fringe of the ridge which looks to produce an abundance of rain for; IL, IN and the Ohio Valley. In the 11-15 day period, the model forms a high pressure ridge across the SE US which would push an abundance of humidity into the Central allowing for widespread and soaking rains. The 11-15 day forecast is wetter than what was offered overnight (which offered a tropical storm for the Florida Panhandle). Our confidence in the GFS forecast beyond the next seven days remains low.

- No bull likes uncertainty in trade or the weather. The US and EU weather forecast models have been in poor agreement for weeks, and our confidence in the GFS is low. And the US is missing its largest buyer, China. If the US made trade progress with NAFTA or China, a strong and quick rally would unfold in Chicago. World wheat trades know the importance of declining Russia and European wheat crop sizes.

To download our weekly update as a PDF file please click on the link below:

Weekend summary 8 June 2018

Our weekly fund position charts can be downloaded by clicking on the link below:

Fund positions disaggregated data