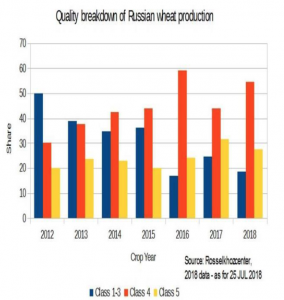

- With the 2018 Russian winter wheat harvest pushing strongly ahead this week, crop quality is being assessed. The graphic provided by Rosselkhozcenter indicates that 81% of the 2018 Russian wheat crop is of class 4 or 5 compared to 73% last year. The shortfall has been in milling grades 1- 3 which accounts for just 19% this year compared to 25% last year. As always been the case in Russia, some man’s bread wheat is another man’s feed wheat. Yet due to a lengthy period of rain during the NE Russian harvest, sprout damage has hurt quality. This could be one reason why Russian 2018/19 all wheat exports will likely slide to 27-28 million mt vs the USDA July forecast of 34 million. Russian exportable wheat supplies could be exhausted by year end.

- It has been a broadly mixed morning with Chicago summer row crop futures weaker while wheat futures are higher. Soybeans prices have given back half of Tuesday’s gains amid the new rhetoric from the White House that US President Trump is willing to raise the stakes in his game of; “US/China tariff poker”. President Trump is said to be preparing to raise tariffs from 10% to 25% on $200 million in Chinese goods that are now under review. The tariffs would not become active until early September, but just the talk of raising US tariffs brought a quick/harsh response from China. The Chinese said that they will not be bullied into any agreement and promised swift retaliation. At this point of; “I’ll see your tariff bet and raise you two”, we hope the White House understands that China will not be bullied into accepting the US’s trade or IP protection terms. In fact, it would help if the US did not raise 10% proposed tariffs and get on to negotiations. China is proving that trade wars are not easy to win. No one can be bullied into accepting “their terms” and it is going to be face to face negotiations that gets a deal done.

- US wheat futures are showing independence from the summer row crops on a continued sharp fall in world production and a daily rally in world fob prices. An explosively bullish set up is developing for world wheat values that could drive prices higher into the 1st quarter of 2019. We find it is hard to know how high is high for US/world wheat values. We do know that $5.60 spot Chicago is not producing any end user rationing. Prices may have to rise another $1.50-3.00 before a final top is set. The wheat market will have a supply driven rally (now underway) that will be followed by a US demand driven rally (after Mid Sept) as world wheat demand is shifted to the US.

- Based on recent crop estimates from Sweden, the Baltic and now Germany, you can safely assume a 2018 total EU wheat production will be below 135 million mt, and potentially as low as 129 million. This total EU wheat production estimate assumes 6.0-6.5 million mt of durum. The USDA forecast the total EU wheat crop at 145 million mt in mid-July. The latest harvest data calls for a 10-16 million mt production drop and that 2018/19 EU wheat exports could be no more than 12-15.0 million mt (down from the USDA July forecast of 27.50 million and last year’s exports of 23.3 million). This is dramatic and amid smaller Russian, Australian and Canadian crops/exports, and a world miller that does not have much forward coverage, it sets up a bullish landscape for US/world wheat prices. We had been using an upside price target of $6-6.50, but such prices will not produce enough demand rationing. Higher wheat prices are ahead and the wheat/corn spread needs to push out to a $2.50-3.00 premium in an effort to shift large tonnages of wheat feeding to corn.

- The central US GFS weather forecast at midday is mixed, slightly wetter across S MN and drier through MO/IL. Temperatures look to average in the 80’s to lower 90’s next week and average out to be some 2-5 degrees above normal. There is no sign of any intense heat in the midday model as was advertised Tuesday morning. The extended range does retrograde a high-pressure ridge westward to the Intermountain West and then progresses it east into mid-August. Whether this ridge will fan more than low 90’s has to be monitored. Heavy rains are forecast through the eastern quarter of the US next week with below normal totals for the Plains and the W Midwest. We forecast US crop condition ratings to edge lower as rainfall totals fall short of crop needs.

- A very bullish S&D outlook is developing for world wheat, which will push feed demand to the US. Bullish outlooks are noted for wheat/corn, and end users are hoping for big US yields to buy a break. Note that the record large NASS August corn yield was set in 2016 at 175 bushels/acre. We doubt that NASS will release a corn yield more than 176 bushels/acre next week. We maintain a bullish outlook on the grains, and leave soybean pricing to President Trump!