- The G20 meeting has started in Argentina and Chicago grain values are firmer on optimism that China will offer to buy more US goods (including agricultural products) to reduce the US/China trade deficit. Most experts agree that there will be little progress on IT protection and China’s industrial ambition, but the key question is whether Trump will allow a “trade truce” to work through the complexities of IT protection. Such a truce would only occur with China’s promise of large Chinese purchases of US goods, and there was a deadline for reaching a IT deal. To date, China has not admitted any theft of IT property and for the Government to agree to negotiations would be a big step forward. USTR head Robert Lighthizer on the sidelines of G20 said that he would be surprised if the China dinner fails.

- For the US is to enter into a “trade truce” would require that China open its market to greater imports of US goods (including ag) that provides Trump with a win in terms of getting China to bend on the Chinese trade surplus. The IT and industrial policy part of US/China negotiations are so complex that it will take months (maybe years) to complete. The hope of the US ag industry is that China is willing to open its markets such that negotiations on IT protection can continue well into the middle of 2019. The next 36 hours will tell if China is willing to throw open their markets and talk IT thereafter.

- FAS announced that 120,000 mt of US soybeans were sold to an unknown destination. The US/Mexico/Canada signed the USMCA agreement today for North American trade. The agreement will now go back to each government for legislative approval. There are political headwinds for a US approval and should there be any long-term approval delays, NAFTA could return. There are objections for Democrats in the House that there is a need for the agreement to be modified. There are rumours that the US is willing to drop their steel/aluminum tariffs early next week now that the agreement is signed. We would highlight that they are only rumours, but that would be enough for Mexico/Canada to drop their tariffs on some US ag goods including meats and dairy products.

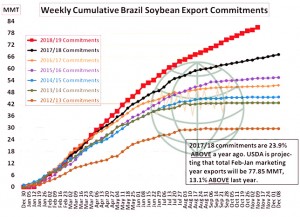

- The Brazilian soy crop estimates continue to rise, we expect that CONAB will raise their crop estimate to 122-124 million mt in their December report.

- The midday S American weather forecast is similar to the overnight solution with much above normal rain to fall across the northern half of Brazil with totals of 3-8.00”. Below normal rainfall is expected across Argentina and S Brazil as spring planting accelerates. No extreme heat is foreseen due to persistent cloud cover across Brazil. Highs will range from the 80’s to lower 90’s across Brazil. The dryness across Argentina and S Brazil is favourable for now, but concern is growing that Asian rust (plant disease) could hurt soy yields in Mato Grosso, Goias and Bahia amid weeks of above normal rainfall. Producers are spraying fungicide to combat the disease.

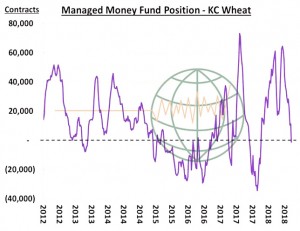

- Sunday night will prove dynamic for Chicago trade as the details of the Trump/Xi dinner is known. The market is optimistic on some sort of truce. We are not alone in not having any idea what the final deal will be. However, amid growing S American crop sizes, one would have to be careful about becoming too bullish as new competition for US soybean exports is only some six weeks off. Wheat has more upside risk as world demand shifts to the US/EU. Corn is a tug of war between soybeans and wheat.

To download our weekly update as a PDF file please click on the link below: