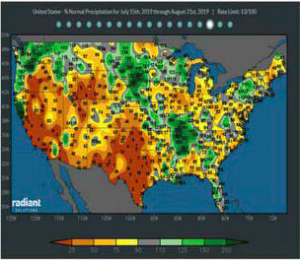

- The E Midwest is becoming involved in a flash drought with poorly rooted crops suffering more with each dry/warm day. The graphic reflects percent of normal rainfall since July 1 and notice that Central IL has been missing the rain. Moreover. temperatures have averaged above normal leading to acute soil moisture shortages. It is the lack of rain across the key areas of the Midwest which move us back into a semi bullish corn/soy market stance until a weather pattern change with better rains is indicated. US corn and soybean crops are again in sharp decline.

- Wednesday was an exceptionally slow day of trade in Chicago soybean markets that left futures a cent higher at the close. An early morning break in other US commodity and financial markets weighed on the soy trade, but the upcoming August Crop Report, along with widespread Midwest dryness offered support. Brazilian cash soybean prices are moving higher as Chinese demand remains focused on Brazilian supply, while the US$ continues to rally against the Brazilian Real. The strong US$ is putting additional Brazilian Reals into the Brazilian farmer’s pocket. Brazilian producers report that they expect the US/China trade war to last least another year and that they intend to expand their soybean acreage by another 2-4% this year (planting season to begin mid-September). Pre report positioning is expected to keep soybean markets quiet at the end of the week. The next major move comes with the USDA August Crop Report on Monday, with prices to respond to the acreage and yield estimates.

- Dec corn ended 2 cents higher as a trend of below normal rainfall looks to persist east of the MS River. Heat develops early next week with highs in the low/mid-90s which will add stress to pollinating corn . The weekly EIA ethanol data was also supportive, and so there was little for the bears to grab onto on Wednesday. The US ethanol stocks fell sharply on a boost in weekly export disappearance. Ethanol stocks are still record large for early August, but no longer are burdensome. We expect ethanol production to slow in the weeks ahead. This will reduce corn’s demand draw but will quickly allow balance to return to US ethanol supply and demand. The longer-term feedgrain outlook is bearish as Black Sea and S American yields accelerate. But in the near term, falling US corn production potential in IL, IN and OH and uncertainty of actual seedings argue against chasing breaks. This is still a market dominated by the US supply bulls vs the long term demand bears.

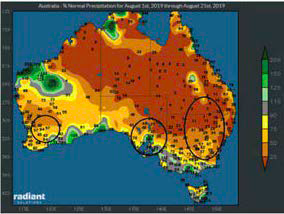

- Chicago wheat futures began the session weaker but ended 4 cents higher. Breaking news is absent, but we estimate that managed funds in Chicago have fully liquidated their net long position since last Tuesday. World cash markets remain flat. US export demand will remain limited to traditional importers. However, more attention will be paid to lingering dryness in Australia in the next 30 days. The attached graphic shows Aug 1-21 % of normal precipitation. Assuming the two-week forecast verifies, the Aussie wheat-growing season will again start with severe/widespread drought in NSW and Queensland. EU and Black Sea markets continue to compete for demand, and Russian export commitments in August are struggling. End user demand surfaces below $4.80. US exports slow further above $5.10. Rangebound trade is seen into early autumn.