- HEADLINES: NASS Reports bullish for Chicago corn/soybeans; Combined 2021 US corn/soybean acres just 180.3 million; June stocks close to trade estimates.

- The June NASS Stocks & Seeding Reports were bullish for US corn/soybeans with Chicago posting sharp to limit up gains. The only bearish surprise was wheat including a slight increase in new crop seeding. The June Stocks/Seeding report raises weather/yield risks for the remainder of the summer and opens the market to further gains.

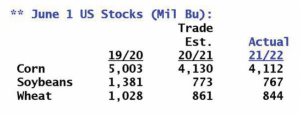

- NASS forecast US June 1 corn stocks at 4,112 million bu, 18 million bu decline from trade expectations, and the lowest US June stocks total in 8 years. We calculate the Mar-June feed/residual use at 882 million bu, down 109 million bu from last year. The Sept-June 1 2020/21 feed/residual use is pegged at 5,509 million bu, up 118 million bu from last year (+2%). USDA is forecasting a 197 million bu decline in US feed/residual for the 2020/21 crop year or -3.3%. The USDA should raise their 2020/21 US corn feed/residual use rate by 50 million bu in the July report.

- US June 1 soybean stocks were 767 million bu, down 6 million bu from trade estimates and down 614 million bu from 2020, the smallest since 2015.

- The March-June US soybean residual is calculated at a +89 million bu, up 11 million bu from last year. The enlarged residual helps to provide comfort in last year’s NASS soybean crop estimate. The soybean market was fearful of larger decline in the residual, compared to pre report estimates.

- US final 2020/21 wheat end stocks were forecast at 844 million bu was down 17 million bu from trade expectations, and down 184 million bu from last year’s stocks total.

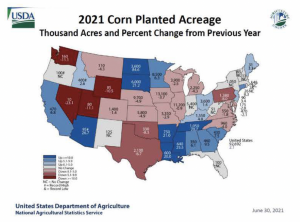

- 2021 US principal crop acres rose to 317.2 million acres, the largest total since 2018 when 319.3 million acres were seeded. The big gains in seeded acres vs 2020 occurred in the Dakotas (North Dakota crop acres up 15.6% to 24.15 million with South Dakota up 8.0% to 16.8 Mil acres). Other Midwest States showed modest seeding gains of 0-2% with Iowa seeded crop acres unchanged from last year. Kentucky cropped acres rose 6% to 5.1 million acres while Nebraska acres fell 2.3% to 19.3 million acres. Kansas held the most cropped acres at 23.5 million acres.

- Combined US corn/soybean acre were below the record at just 180.3 million acres. US corn seeded acre rose by 1.6 million acres from the March intentions to 92.7 million acres,while soybean seeding held steady. The big corn seeding gains (from March) occurred in N Dakota, S Dakota and Minnesota which showed a bump of 9.1%, 7.1% and 6.3%, respectively. This is the same area struggling with dire drought which hold bearish yield implications. These 3 states account for 18.1 million corn acres or 19.5% of the US total.

- NASS estimated US 2021 harvested corn acres at 84.5 million acres, up 1 million from the March Intentions forecast. NASS stated there was 2.18 million acres of US corn left to be planted when the survey was conducted which suggests if there are any reductions, they will be to the downside when FSA data is included.

- US 2021 soybean seeded acres held steady with March at 87.6 million acres, which was steady with the March intentions survey. Harvested acres were placed at 86.7 million acres. This was the third largest US soybean seeding pace on record, behind 2017 and 2018. Like corn, the big gains occurred in the Dakotas with North Dakota seeding 7.2 million acres, up 25% and South Dakota up 11% at 5.5 million acres. Texas, Mississippi, Georgia, South Carolina, and Wisconsin acres were also up on a percentage basis substantially. NASS indicated there were 9.84 million acres left to seed when the survey was completed.

- US spring wheat acres were 11.58 million acres, up modestly from expectations. US total wheat acres were 46.7 million, a 600,000-acre gain from March. The wheat seeding gain is being overlooked amid worsening weather across the N Plains. US wheat futures are holding strong gains.

- The USDA report is bullish and raises the stakes for rain for the drought-stricken areas of the N Plains/NW Midwest. The GFS midday weather forecast reduced totals for most of this area vs. the overnight solution. We maintain an outlook for new contract highs in new crop corn, wheat and soybeans.