- The USDA September Stocks in all positions estimates were bearish for corn and soybeans, and neutral for wheat. NASS revised the 2017 US soybean crop upwards by 19.1 million bu (4,411 million bu) amid the larger stocks total. US corn stocks at 2,140 million bu came in 138 million bu above the average trade estimate. The stocks total will add to new crop ending stocks. US wheat futures are expected to gain on both soybeans and corn heading into the Chicago close. The US estimated the final 2018 US all wheat crop at 1,884 million bu, up 7 million from August. The winter wheat crop was cut 5 million bu with the spring crop raised 9 million bu. The durum crop was also slightly larger which allowed for the modest US wheat crop recovery. Compared to 2017, the 2018 US all wheat crop was up 8% with yield at 47.6 bushels/acre. The HRW crop was pegged at 662 million bu.

- The US SRW wheat crop was 285.6 million bu with soft white wheat at 216.8 million bu. The production total was in line with trade expectations and the focus of the marketplace will totally shift to world prices and US export demand. US final all wheat production at 1,884 million bu is considered neutral. US September 1 wheat end stocks of 2,378 million bu were slightly above the average trade estimate of 2,355 million bu. The stocks total implies a Q1 feed/residual use rate of 200 million bu, up 30 million from last year, but below the 5-year average of 279 million bu. The diminished US harvest likely curtailed the Q1 residual, but the feeding rate was larger than expected.

- The US September 1 corn stocks estimate of 2,140 million bu was 138 million above the average trade estimate and considered bearish. The Q4 US corn feed/ residual use rate is calculated at just 595 million bu, down 92 million from last year, and 103 million bu above the 5-year average. The heavy movement of corn off the farm during the late summer likely produced the reduced feed/residual use. Corn in the hands of commercials is often more accurately counted. Adding the additional old crop US corn old crop stocks would raise 2018/19 US corn stocks near 1,900 million bu assuming no change in yield or demand within the Oct WASDE.

- The 2017 US soybean crop was raised 19.1 million to 4,411 which pegged 2017/18 US soybean end stocks of 438 million bu. Such stocks are up 43 million bu from the September WASDE and will elevate 2018/19 soybean end stocks to 883 million bu assuming no change in WASDE demand and or yield.

- The September Stocks report added to the new crop supply of corn/soy. The report is seen as bearish and Chicago futures are lower at midday. The wheat report was neutral and rising world prices will offer support. Wheat values are now a function of US export demand and world price differentials.

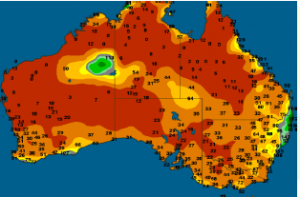

- The central US GFS weather forecast calls for cool/wet weather across the NC Midwest for the next 10 days. Short waves will be pulling across the Plains/Midwest every 2-3 days which will slow the pace of harvest. Progressively colder temperatures will be pouring southward into mid-October. The cool/wet weather offers no chance to accelerate the Midwest corn/soy harvest.

- The USDA September Stocks report is bearish with an extra 138 million bu of corn and 43 million bu of soybeans found. US 2018 all wheat production came out broadly as expected. It is going to be tough to pressure December corn below $3.55 amid building US export demand. But a US corn yield decline is demanded in October for lasting bullishness. Soybeans lack a demand story amid China’s absence. The only real story going forward is US wheat should world demand shift as expected.

To download our weekly update as a PDF file please click on the link below: