- Chicago futures are lower at midday as traders take off risk ahead of the weekend with rain slated to drop across the S Plains late next week. Kansas wheat has been leading the decline in recent days as the market extracts weather premium. The rain will be important for wheat values late next week, but the models appear to becoming confident in its arrival. The tone of the market feels heavy at midday as weather/political concern exist. The market is uncertain on the US’s reaction to Syria and what will happen in the rain forecast for the Plains and Midwest. Moreover, US/China trade issues are likely to deepen as progress in the past two weeks has been nearly nil. The research view has been sideways with extreme volatility continuing, with advice being don’t chase rallies or sell sharp breaks. Chicago floor brokers report that funds have sold; 6,000 contracts of corn, 4,600 contracts of soybeans, and 4,200 contracts of Chicago wheat. In soymeal, funds have sold 2,800 contracts of soymeal while being flat in soyoil. The funds continue to pile into a larger net long soybean/meal/corn position.

- There were no new sales announced through the USDA Daily Sales reporting system this morning. This was a surprise to some traders. Rumors continued to swirl that Argentina had purchased additional US soybeans, but US exporters have not offered such confirmation (other than the cargoes that sold late last week and Monday). One cannot pencil a profit on US soybeans into Argentina with the products to be exported. The lack of a crush profit will keep Argentine import totals of US soybeans subdued for now. This is not to say that a break in US soybeans would cause the calculation to go positive, but we doubt that Argentine crushers will take on the risk without a healthy import margin. Brazilian fob soybean basis has corrected sharply this week as US and China headlines on trade were replaced by other political issues like Russia and Syria. Brazilian fob soybean offers are at $1.30 over for July (compared to $1.95 over last Friday), while US soybean fob rose to $.92 over. The spread at $.38 over is far less than $1.00 plus from last week. EU crushers are not interested in shifting their sales to the US at such a fob vs fob spread. Note that Brazilian soybeans normally trade at a $.15-.20/bu higher value vs the US due to its higher soyoil content. Chicago corn prices have had trouble rallying this week to the surprise of the bulls as Midwest seeding is delayed. However, Brazilian fob corn has declined and is now cheaper than the US Gulf at $187.50/mt for July. US Gulf corn is priced at $194/mt, or $6.50 higher. The Brazilians are starting to aggressively offer corn and offering a cheaper alternative to US product.

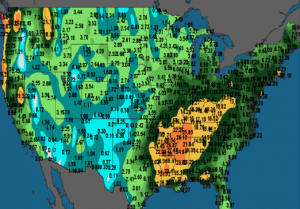

- Traders are cutting their risk in a host of markets, excluding energy where this week’s close will be the best in years on Mideast political concern. This is a headline marketplace and we see no reason why that will change. This week, Brazil has become a more aggressive seller of winter corn, while soybeans were not able to poke above their winter spot high price. In wheat, its all about Plains rainfall amounts, watch this space.

To download our weekly update as a PDF file please click on the link below: