- It was a quieter inside day of trading for the soybean market, with prices correcting ahead of the weekend. Soymeal finished firm, which lifted crush spreads to new highs, while March bean oil went out at the lowest price since June. The March spread ending the week at $1.26/bu, which on a spot basis was the highest since June 2016 (Argentine crop problem). On a seasonal basis, the spot spread is at an all time record for mid-February. The previous record was set in 2015, when the spot spread reached $1. The meal market continues to add premium to soybeans on concerns that steep crop losses will cut into crush rates and meal exports. Soybean harvest in Mato Grosso advanced by just 9% this week to 29% complete, versus 46% last year and the 5 year average of 32%. The afternoon EU weather model keeps Argentine rains largely North of key soybean areas. The lower 2/3rds of the soybean belt looks to see less than an inch of rain over the next 10 days, while high temperatures reach back into the upper 90’s late next week. Crop concerns are escalating with time.

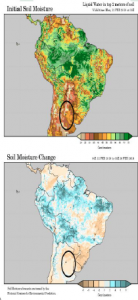

- Spotty showers will occur on the weekend in Central Argentina, but widespread soaking rain, which is now required, is not indicated. It’s almost too late for a pattern change to materially impact corn yield following cumulative Oct-Jan precipitation of just 65% of normal. Dry weather returns to Argentina in the 4-12 day period, and should this arid forecast verify, drought will be confirmed. Without a very quick and major pattern change, it’s likely that final corn yield in Argentina exists some 20-25% below trend. This implies a crop of just 31-34 million mt, and corn exports of no more than 21- 23 million mt, vs. 26 million last year. There’s evidence to suggest La Niña will weaken, and fade by late spring, but in the meantime, there is no change in the overall S American weather pattern. Chicago spot corn futures will uncover strong support under $3.60 amid the smaller Argentine corn crop. The loss of 8-11 million mt of Argentine corn makes the size of the Brazilian winter corn crop more important!

- US wheat futures closed down from 6 to 13 cents. The largest losses came in the HRW contract with the March contract off 9.25 cents. The jury is still out on when and how much moisture is due for the US Southern Plains. At this point any “Rain on the Plains” can only help. The downside to the market’s bullish enthusiasm over the Plains Drought is that there is plenty of other wheat to meet exporters needs. Today, it was announced the Russia recently made sales to Indonesia and S. Korea, far from their tradional markets in the Mideast.

To download our weekly update as a PDF file please click on the link below:

Weekend summary 9 February 2018

Our weekly fund position charts can be downloaded by clicking on the link below:

Fund positions disaggregated data