- In a general sense, world raw material prices are rising, to the exclusion of the ag commodity sector. Funds are holding a near record short position in agricultural futures as general ag prices slump. For some reason, food prices are not participating in the world economic growth cycle. Historically, it is food that leads as emerging nation wealth leads to enlarged spending on calories. Some argue that it is abundant world grain supplies and the prospect that NAFTA could be dismantled to the detriment of US trade. One could argue that US ag should be participating in the commodity reflation.

- It feels like Chicago fund traders have hit the “pause button” with corn, soybean and wheat futures trading mixed at midday. The volume of trade is far less than Monday’s fund inspired selling spree. That selling was met with strong end user pricing as evident by the 40,000 contract rise in Chicago corn open interest. March corn is back hugging $3.50, March Chicago wheat back to $4.30, while the soybeans languish on intra-market spreading. March soybeans are holding their prior lows against $9.55. We would point out that funds fired considerable bearishness at corn, soybeans and even wheat with large sales on Monday. The market absorbed the selling and is recovering this morning. This tells us that there is scale down pricing from end users, and that even if Friday’s USDA report is bearish, the downside risk appears limited, this is no place to side with the bears. Chicago floor brokers estimate that funds have sold 3,000 contracts of soymeal, while buying 2,400 contracts of wheat and 4,500 contracts of corn. Funds have also bought 1,000 contracts of soyoil and sold 3,000 contracts of soybeans.

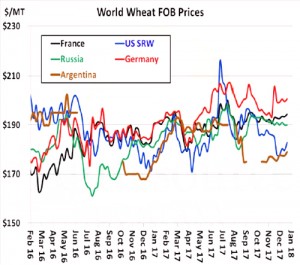

- Egypt’s GASC received seven offers for wheat with one offer seeming very cheap at just above $192/mt. The offers came once the Government offered assurances that demurrage would not be an issue with any new sales. World exporters object to paying demurrage on any wheat that is sold as fob. Egypt secured 115,000 mt of Russian wheat in the tender.

- Australian Statistical Bureau estimated the 2016/17 wheat crop at 30.4 million mt vs ABARES estimate of 35.0 million million mt, previously. We note that WASDE pegged the 2016/17 Aussie wheat crop at 33.5 million mt, so the difference between the Australian Stats agency and its own estimate is only 3.1 million. We would note that WASDE does not have to follow the Aussie Stats Bureau and can maintain their own estimate of 33.5 million mt. Nonetheless, Research argues that WASDE should lower 2017/18 Aussie wheat exports by 2 million mt to 15.5 million due to its high fob prices amid static world wheat demand. Unfortunately, the loss or gain of 2-3 million mt of Aussie wheat from more than a year ago does alter the bearish outlook for world wheat prices going forward. The world is still awash in wheat with Russia continuing to be aggressive on offers.

- Soybean rust concern is increasing across Central Brazil amid all of the recent rains. The rust is causing producers to reduce their soy yield estimates.

- Chicago is likely to keep chopping sideways into Friday’s report. Brazil’s CONAB will be out with their crop estimates on Thursday followed by the USDA on Friday. We look for a Brazilian soy crop of 111-111.75 million mt from CONAB, up 3-3.75 million from the USDA’s December forecast. Chinese December trade data will also be out overnight along with the Index rebalance at the close in Chicago.