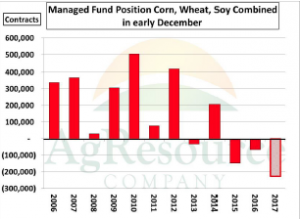

- Managed funds as of last Tuesday were short a combined 355,000 contracts of corn and wheat, which is by far a record. In our view there are more than enough questions over 2018 US and global grain surpluses to trigger periodic short covering rallies and, really, not until late spring will S America’s corn export potential be solidified.

- Following a higher start to the morning, soybeans quickly turned down, shrugging off the morning’s export sales announcement and inspections data. Soymeal is where funds still hold the largest position, and it was the meal market that lead prices lower. Commodity fund traders were estimated sellers of; 8,000 soybean, 3,500 soymeal, and 2,000 soyoil contracts. Ahead of the morning open, the USDA announced export sales totaling 14.6 million bu to China. Other trade news for the morning included the weekly inspections data that showed that soybean export inspections were well above expectations and totalled 65 million bu last week. Cumulative inspections for the year are now at 950 million bu, or 141 million (13%) behind last year’s export pace. Funds started the week cutting back their meal position and selling out the rest of the soybean position ahead of the end of year holiday season. The near term Argentine weather forecast are favourable, while the extended outlook turns hot and dry. Key chart support sits just under the market.

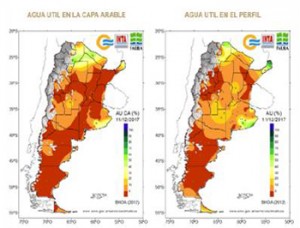

- Corn futures ended steady again, and unlike beans are not extracting weather premium from price. As we have mentioned in recent days recent and upcoming rainfall in Argentina is incredibly important, but so too is the US Gulf market’s position in the world market. Real weakness in cash prices in Argentina isn’t expected until the first crop is harvested in early February. In the meantime we fully expect the US to be world’s go-to origin. US exporters also sold another 168,000 mt of sorghum to China this morning, and China’s appetite for US sorghum will not be slowed at current prices. There is still a sizeable margin for sorghum imports, and room for an additional rally in sorghum prices worth $20-30/mt, basis US Gulf offers. Sorghum basis across the interior US is atouch stronger this week, and the goal of that market is to secure additional acres in 2018. Note, too, that excessive heat in E Australia may trim sorghum yields there. Funds maintain a sizeable net short position (still near-record large), and there are enough questions over S American surpluses and US acreage to keep downside risk limited at current prices.

- US and European wheat futures ended slightly higher, mostly amid a noticeable lack of new selling. As of last Tuesday managed funds were short a near-record 158,000 contracts in Chicago, and were short a record 32,000 contracts in Kansas. Meanwhile, HRW basis levels continue to strengthen and there are hints that a much colder (or seasonal) temperature pattern lies in the offing in Ukraine and S Russia in late December. Without near perfect weather next spring, the US balance sheet will be tightening further, perhaps substantially. Meaningful rainfall remains absent from the Plains forecast into the opening days of January, and close attention needs to be paid to overnight low temperatures next week, and longer term, and an unstable Polar Vortex is likely to trigger additional rounds of frigid temperatures through the winter. A demand spark is so far absent, but funds’ short positions in mid-December suggest a vast majority of bearish news has been accounted for. New selling must be led by the cash market, which unlike recent years is firming.