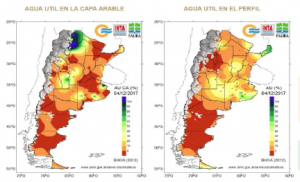

- Much of Argentina is parched, drier than a year ago. The map below, on the left, shows topsoil moisture while the chart to the right is subsoil. Notice that subsoil moisture is currently only 20- 40% of normal, meaning that upcoming rainfall will be highly important for crops during the last half of December.

- Following firm overnight trade, soybean futures rallied to strong gains on Tuesday. Weather models project limited rains across key growing regions for Argentina and S Brazil, which fueled fund buying through Tuesday’s trading. Soymeal led Tuesday’s rally on concerns that Argentine meal exports could be reduced by a smaller Argentine crop. At the close, funds were estimated as net buyers of; 9,500 soybeans, 7,000 soymeal, and 1,000 soyoil contracts. Soymeal trade data for October was disapointing. US exports totaled 781,746 short tons, a 16% decline from last year, and the slowest October export figure since 2011. While the USDA has a long history of underestimating soymeal exports, it appears that the current forecast is not likely to increase without a big jump in shipments. We expect Chicago soy markets will continue to add weather premium until the S American weather forecast changes. However, US soy supplies are record large and we would believe that Argentine dryness would have to cut 10% off yield expectation to justify a rally above $11.00.

- Chicago corn inched to minor gains, and March is positioned firmly between its 50-day moving average and its contract low. Weather premium needs to be sustained until/unless it rains in Argentina and S Brazil, but the trade is also beginning to position for next week’s WASDE, in which large US and global stocks will again be confirmed. There is little to do other than wait for clarity on Jan-Feb S American weather, but we do mention that newly updated climate outlooks indicate ongoing heat and dryness in Argentina through January. Wednesday’s EIA report should again include near record US ethanol production through the week ending last Friday, and still there is no indication of any real slowdown in ethanol export demand. Brazilian cash ethanol prices continue to move higher, and the rally has more than offset Brazil’s 20% tariff on imports from the US. China also looks to ramp up its blending program, which at first will be comprised of imported ethanol. The battle between slow exports, but strong biofuel consumption and adverse S American weather will, in our view, sustain fair value at $3.48-3.65, basis March Chicago futures.

- US wheat futures ended lower, as again markets were unable to find much buying interest at technical resistance price levels. Funds returned to adding net short positions. Traders across the globe are beginning to wind down for the year, but there remains no compelling evidence for a major move in either direction. Ongoing warmth in the Black Sea, where temperatures remain some 15-20 degrees above average, will sustain Russian shipments in the weeks ahead, but managed funds’ net short position this evening is pegged at 120,000 contracts, little changed from last week and still sizeable relative to history. While Russia wheat prices continue to do very little, higher protein markets elsewhere have rallied decently in the last two weeks. German fob prices are testing multi-week highs, and contacts suggest the rally there is fundamentally based. We remain close to contract price lows, and the US wheat balance sheet will be tightening in the years amid the loss of acreage and a lack of substantial yield growth.