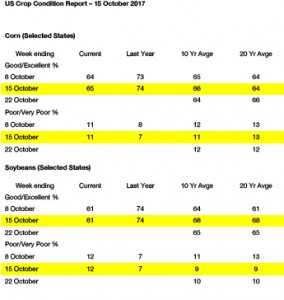

- US crop condition data has been released as follows:

- Soy futures were lower to start the week on improved Brazilian weather foercasts that left prices down 8-9 cents. Daily US export sales of just over 8 million bu announced, while soybean export inspections were the largest of the year at 65 million bu. Yet, US soybean exports need to ramp up to 100 million bu or more per week to match last year in October. NASS reported that as of Sunday, US soybean farmers had harvested 49% of their soy crop versus 36% last week, and the 5 year average of 60%. Heavy weekend rains will slow harvest in the first half of the week, but fortunately the forecast for the week ahead stays dry late October. US crop ratings have had diminished importance in what will be the last condition report of the year, NASS marked the crop at 61% good/excellent. November soybeans started the week with profit taking after testing a weekly downtrend line at $10 on Friday. Soybean yields have far exceeded our summer expectations. Without a Brazilian crop problem, the outlook is bearish on rallies with an initial downside price target of $9.60-9.70 as 1st notice day nears against November.

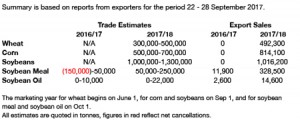

- A more active Midwest harvest and the continued reports of better than expected yields, along with slowing US export demand pressured CBOT corn futures to a lower close. Funds ended the day as net sellers of 5,400 contracts of futures with December pinned against $3.50. US corn exports for the week ending October 12th were just 12.7 million bu, the smallest total since the week ending November 5th, 2015. The slow export pace does not bode favourably for US corn exports into early 2018. Research maintains a US corn export estimate of 1,725 million bu, down 125 million from the WASDE October forecast. Without any change to yield, such a slower US corn export pace would raise US 2017/18 corn end stocks to 2,465 million bu. NASS reported that just 28% of the US corn crop is harvested, vs 44% last year and a 47% 5 year average. 90% of the US corn crop is mature, down from 96% last year and 94% average. 65% of the US corn crop is rated good/excellent, up 1% from the prior week amid solid yield reports. Producers continue to report better than expected US corn yields across the Midwest. The better yields likely will cause NASS to raise their US corn yield estimate in the November report. It’s remarkable that the 2017 US corn yield could equal 172-173 bushels/acre. Corn lacks any bullish fundamental story amid slow US export demand and solid yields. 70% of the ‘17 US corn crop has yet to be harvested. If December corn starts to technically slide, prices could drop to $3.30 which would push funds to a net short position of close to 200,000 contracts, but, if December is unable to close below $3.45 by Friday, this would portend that much of the bearish news is digested.

- US wheat futures failed to sustain an early rally effort and closed lower. Fund short covering ended at mid morning and selling pressure returned amid weakening global wheat prices. Australian wheat values dropped on improved weather for Southern New South Wales and Victoria, while traders turned their attention to the Algerian tender and what price French fob values would need to fall to to secure a sale. Funds ended Monday as net sellers of 2,300 contracts of wheat. The US wheat market lacks a bullish fundamental story into yearend. US wheat export inspections for the week ending October 12th were just 11.9 million bu with total crop year exports at 390 million bu, down 10.5 million or 2.5% from last year. US wheat is competitive in the world marketplace, but so far this has not translated into better export demand. The US has planted 60% of the 2018 winter wheat crop vs 71% average. New crop wheat prices are not deemed as attractive to producers. We estimate ‘18 US total wheat seeded acres to 48.5 million acres, mostly due to gains in spring, durum and white wheat seeding. In 2016, the US planted 46.0 million acres of all wheat and in 2015 the US planted 50.1 million acres. So a 48 million acre seeding total is in the middle amid the improved soil moisture profile. Argentine wheat is the cheapest in the world as dry weather has helped the crop with 12.5% pro wheat pegged $14/mt under French wheat. Russian fob wheat has started the week steady at $193/mt while most traders believe the upside is becoming limited in Russian wheat to $200/mt beyond December shipment.