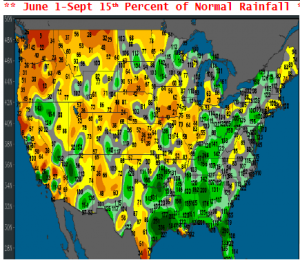

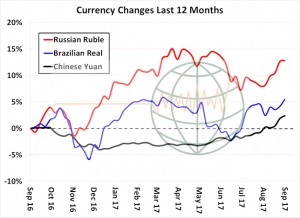

- Early selling in November soybeans found support at the 100 day moving average that pared back losses and left November 2.25 lower for the day, but 7 over the early morning low. Soybean oil had support under the 50 day moving average, and meal was lower on meal/oil spreading. Early Brazilian soybean planting is now underway, though producers across the country will likely wait for better rains to develop over the next several weeks. The question for this year is the extent that Brazilian producers will expand soybean acreage. Soybean area has increased every year for the last decade, and the USDA estimates another 2% expansion this year. In US$ Chicago is 1% higher, but 2% lower in Reais. CONAB’s initial estimate for soybean area is still a month away, but at the start of the year, producers are facing below normal soil moisture and lower prices.

- December corn fell another 3 cents as ongoing Central US warmth should accelerate crop maturity, and as there are signs of better rain chances in Southern and Central Brazil beyond the next 10 days. We view the recent break as mostly chart-driven, and major technical support and resistance lies at $3.45 and $3.55, respectively. The EIA’s weekly energy report, due Wednesday morning, should include steady (and record large for the week) ethanol production, but key will be the pace of non-domestic ethanol disappearance. So far, non-domestic use has shown no signs of slowing despite Brazil’s approved tariff on imports from the US. Brazil’s ethanol market continues to rally, and US production and blending margins remain elevated. S America’s cash corn market has been stale in recent weeks. Argentina is still the world’s low cost origin, and by $.20/bu. However, feed wheat does not look to displace as much total corn demand this year. It may be premature to lower US corn exports below the USDA’s projected 1,850 million bu. We would note that downside risk in S American corn, and world feed/milling wheat prices, is limited.

- Wheat futures worldwide did very little today, but cash markets are noticeably firmer following Egypt’s latest tender result. Egypt secured 175,000 mt of wheat from Russia, which is not surprising, but at an average fob price of $197/mt, a full $10/mt higher than its last purchase in late August. The Russian market continues to find demand, and amid limited export capacity fob prices there continue to rise. Russian wheat, again, the world’s driver of price in August to November, is still offered well below comparable EU origin, and so a collapse in value is not imminent, and Russian wheat is competitive up to $196-198/mt, vs. quotes this evening of $188 (note that Egypt again is paying a steep premium amid phytosanitary issues). The point is we doubt much downside risk exists in even US futures. Rain is needed in Australia, E Ukraine and S Russia.