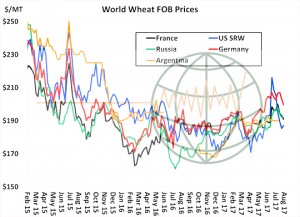

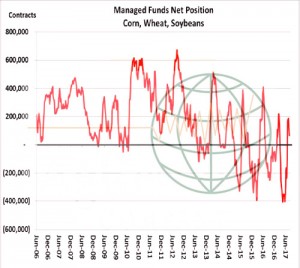

- Low volumes and mixed trade have been the hallmark of today’s trade in Chicago after an active overnight session that followed the release of the latest USDA report. Corn and soybeans have been mostly in positive territory whilst wheat has seen weakness on the back of fund selling. Global wheat cash prices are holding better as Chicago futures are still struggling on the back of fund unwinding of net long positions, particularly in higher protein wheats.

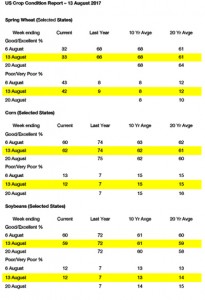

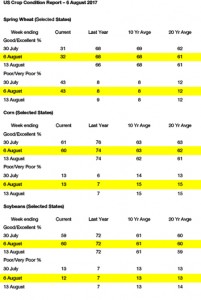

- We do note that NASS did not change its harvested acreage estimate for 2017 US spring wheat as it did not go back and ask producers how much of the crop they intended to harvester some strange reason That “harvested acre” question will occur with the September Final Small Grains Summary Report on Sept 29th. We maintain that based on history in dry weather years, that Final Small Grains report could well uncover that 1-1.5 million acres will not be harvested, and that will drop the US spring wheat production total to 325 million acres or below. Fundamentally, spot Minneapolis wheat futures should uncover strong support at current depressed prices.

- The US Pro Farmer crop tour starts on 21st August, and should help uncover some clues as to the true picture on corn and soybean yields. It has a pretty good track record on forecasting the figures for the September USDA report, so worth keeping an eye on. The upcoming Tour becomes more important, in our eyes, given the question marks we have raised over the latest data release. Traders and producers are disgruntled with USDA’s August Crop estimates, but they thinking ahead to the rest of the 2017 Central US growing season. How might the weeks remaining compare to recent years? Will the growing season be extended and will there be any hurricanes that push northward from the Gulf? We note that 40% of the N Dakota soybean crop had not entered the pod phase as of last Sunday. A normal/frost freeze event in the Dakotas is a 2017 production risk as is the just pollinated replanted corn in IL/IN. We understand and appreciate the gloom and doom that prevails, but our confidence in USDA August yield estimates is pretty low.

- Minneapolis wheat is currently lower on fund liquidation, KC and Chicago wheat are following. Corn and soybean futures are slightly higher on end user pricing. China is likely to become more active in making forward soybean and product purchases. Market volatility rates will be declining with traders listening to private reports from corn/soybean fields.

- To download our weekly update as a PDF file please click on the link below:

Weekend summary 11 August 2017