To download our considered view of the November USDA report please click on the link below:

Author Archives: simon

9 November 2016

- The USDA’s November WASDE is viewed as moderately bearish. Soybean yield was raised, which was expected, but by a bit more than thought, and surprisingly US corn yield was hiked to a new record 175.3. US corn ending stocks were lifted 83 Mil Bu to 2,403 Mil, soybean stocks were raised 85 Mil to 480 Mil, while wheat stocks were raised marginally to account for lower projected food consumption.

| November ’16 WASDE Yields: | |||

| Oct | Nov | ||

| 2015 | 2016 | 2016 | |

| Corn | 168.4 | 173.4 | 175.3 |

| Soybeans | 48.0 | 51.4 | 52.5 |

| November ’16 WASDE US End Stocks: | |||

| Oct | Nov | ||

| 2015 | 2016 | 2016 | |

| Corn | 1,738 | 2,320 | 2,403 |

| Soybeans | 197 | 395 | 480 |

| Wheat | 976 | 1,138 | 1,143 |

- Corn yields were raised across much of the Central US, with major upward adjustment noted in ND and MN, harvest results there did improved as the season progressed, and NASS’s ten state ear weight was pegged at 0.36lbs/ear, vs. 0.355lbs in October. It is a surprise, but NASS’s yields in November are typically very close to final, therefore these numbers will be used moving forward. Soybean yield at 52.5 is a new record and some 14% above the 30-year trend, and this deviation from trend is something that has not been seen since 1994. Substantial increases, compared to October, are noted in MI, WI, MN and KS. The USDA raised ethanol demand draw 25 million to a record 5,300 million bu. Other industrial corn use was boosted 60 million bu, but amid production of 15.3 billion, and total supplies of just over 17 billion (vs. 15.4 billion in 2015/16), a stock building year lies ahead. US corn production is forecast to exceed total consumption by a sizeable 600 million bu. Soybean exports were raised 25 million bu to 2,050 million, but crush was lowered 20 million bu amid a decline in projected meal exports. Total US soybean consumption was raised only 7 million bu, allowing end stocks to jump considerably.

| November ’16 WASDE World End Stocks: | |||

| Oct | Nov | ||

| 2015 | 2016 | 2016 | |

| Corn | 209.4 | 216.8 | 218.2 |

| Soybeans | 77.1 | 77.4 | 81.5 |

| Wheat | 241.0 | 248.4 | 249.2 |

| Total | 527.5 | 542.6 | 548.9 |

- Global corn and soybean stocks were lifted slightly, mostly to account for higher US ending stocks. S American corn and soybean production was left unchanged, and major exporters’ corn stocks were also left alone. Slightly higher production is offset by rising global trade. Global numbers are far less exciting than US balance sheet changes.

- Corn, soybeans and wheat are down 5-20 cents at midday, with soybean leading the way, which is probably a fair and reasonable reaction. Indeed, yields were surprisingly high, and the need for the markets to find demand will remain intact. However, on breaks the markets will continue to find this needed demand. Following today’s price action, Gulf corn will be offered even further below other origins and at parity with Black Sea feed wheat. US Gulf HRW’s discount to Russian origin will be rising, and reliable S American soybean exports are still some months away. For some while research has indicated corn will trade at $3.35-3.60, basis spot futures, into late 2016. Soybeans are valued fairly between $9.75-10.20, basis January ’17 futures, with wheat’s range pegged at $4.05-4.30. NASS’s November crop report did little to change this, and we maintain that the next major driver of price will be S American weather in late December and early January. It is a bearish report, but Chicago futures are already viewed as cheap relative to biofuel margins and global prices. Neutral, choppy trade is still projected through the end of 2016.

- Away from the report we should note that Egypt purchased a further 240,000 mt of wheat for mid December shipment in its latest tender. Russia picked up 180,000 mt with Romania the balance of 60,000 mt at an average price reported to be $199.31/mt basis C&F. Interestingly, the price paid is close to $6.00/mt above the last tender and some $26 above purchases made last summer!

9 November 2016

To download our USDA data recap please click on the link below:

8 November 2016

- Today, which is the day of the BIG US vote, has seen Chicago markets surging higher with the funds emerging as big buyers and end users adding to coverage ahead of the election results as well as tomorrow’s USDA crop report. Soybean oil has led the way higher on the coattails of Malaysian palm oil, which overnight reached two year highs. Grains were the follower.

- The most common explanation for the Chicago rally is that everyone is bearish! Traders are wondering who will be the sellers following the USDA report with US producers nearly completed with their summer row crop harvest and US corn, soybean and wheat exports (shipments as well as commitments) well above last year. Our guess is that short covering precedes the USDA report, but that with S American weather largely favorable, it will be difficult to sustain a post report rally in Chicago futures.

- Since mid summer we have been outlining our expectations for a “big crop”, “big demand” marketplace with a seasonal rally high to be posted sometime between late October and mid November. Our thinking has not changed assuming normal S American weather. The point is that Chicago markets would be trading in a range with neither rallies or breaks being able to follow through in a generally range bound marketplace. January ’17 soybeans above $10.25 and December ’16 corn above $3.60 appears to us to be fundamentally unjustified at this time.

- Mato Grosso and much of the N Brazilian soybean crop has been planted at a record fast pace this year. This means that as much as 9-11 million mt of Brazilian soybeans could be harvested by mid February given normal weather conditions. This would potentially place Brazil as a much more aggressive and earlier soybean exporter than in previous years. Furthermore, this would allow Brazil a more lengthy window to seed their winter corn crop and for seasonal rains to fall. The outlook for Brazilian soybean and corn crops is improving amid the fast seeding pace and favourable weather pattern to date.

7 November 2016

- Chicago markets have started the week with the grains, corn and wheat, lower and soybeans trading in positive territory. Weekly US export inspections remain robust with weekly soybean figures near record high levels. Clearly export demand for the US is positive and as a consequence becoming bearish is somewhat difficult until such time as we are more informed upon how S American crops are faring.

- It has been noticeable that cash wheat prices in India have been escalating and it seems that their import campaign will continue for the foreseeable future. Black Sea wheat prices firmed at the end of last week despite Egypt’s currency float and associated devaluation, the US remains well placed to pick up global trade at the present time.

- In S America the latest weather forecast is unchanged with some less than welcome rains in the wettest parts of Argentina’s southern agricultural belt for the next few days, however dry and warmer weather is currently scheduled to follow. That aside, normal to above normal rain is forecast across most of C and N Brazil, which will help to replenish soil moisture levels there with even the dries parts on NE Brazil getting better rain chances into late November.. Whilst planting delays are noted in Argentina we see the overall climate as non-threatening at this time.

- Overall, whilst we have seen barn busting soybean and corn yields and bountiful wheat supplies in the US this season, there is doubtless pressure on S America to perform. Consequently, if there is going to be a move lower in prices it is unlikely until early 2017 when the state of play in S America is better understood. We have seen in previous years a degree of “counting the (S American) chickens” before their crops are guaranteed, we should ensure that we do not fall into this trap in the coming year.

4 November 2016

To download our weekly update as a PDF file please click on the link below:

Weekend summary 4 November 2016

Our weekly fund position charts can be downloaded by clicking on the link below:

3 November 2016

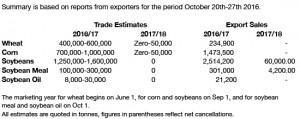

- US weekly export data released today is as follows:

- Brussels has issued weekly wheat export certificates totalling 452,003 mt, which brings the season total to 8.99 million mt. This is 1.03 million mt (12.97%) ahead of last year. Barley exports for the week reached 40,175 mt, which brings the season total to 1.33 million mt, which is 2.96 million mt (69.1)% behind last year.

- Strong weekly US export sales saw Chicago markets rally early on but fund selling (re)emerged in wheat as fund managers still appear to be in liquidation mode taking risk off the table ahead of next week’s USDA crop report. December ’16 Chicago wheat futures dropped below the 20 day moving average whilst corn prices continued to soften. A comment echoed by a number of fund managers, who are holding their smallest positions in many years, suggests that there are too many unknowns to hold large positions. Once the US election results are known and the USDA report is published this may well change.

- US soybean export sales were the largest of the marketing year to date with China reported to have taken 19.4 million mt, and the “unknown” destinations accounting for 9.8 million. More than half of the “unknown” volume will likely end up in China, which means that China has now secured some 900 million bu of US origin soybeans. Estimates suggest that they will take at least 32 million mt (1,175 million bu) of US soybeans in the season.

- Black Sea wheat prices are steady to firm with farmer selling lacklustre, the outlook for Black Sea wheat remains seasonally up into the winter and snow cover across Russia is dramatically expanding southward. Some traders doubt that Egypt’s floating of their currency will have any substantial impact on their future wheat demand. The public buyer, GASC, will likely have to take up a greater portion of demand from the private sector and we would anticipate a new wheat tender next week.

- The market is continuing to liquidate and we see support at $9.80 (Dec ’16 soybeans), $3.42 (Dec ’16 corn) and $4.08 (Dec ’16 wheat). We still see Chicago markets as rangebound with limited downside and we would be reluctant to sell breaks or buy rallies. The “big crop” “big demand” marketplace is still in evidence and when one trader wants to “zig” there will be others wanting to “zag”. Beware!

28 October 2016

Our weekly fund position charts can be downloaded by clicking on the link below:

27 October 2016

- Brussels has issued weekly wheat export certificates totalling 243,580 mt, which brings the season total to 8.54 million mt. This is 967,407 mt (12.6%) ahead of last year. Barley exports for the week reached 4,315 mt, which brings the season total to 1.28 million mt, which is 2.9 million mt (69.3)% behind last year.

- Chicago markets are trading up again as we write this (earlier than usual) in a continuation of overnight price action with soybeans higher in technical trade, corn rallying with the beans and wheat also higher in line with higher global levels. The soybean complex is experiencing an upside breakout in meal on the back of a global growth theme, which it seems is the current mantra from some of the funds. Clearly the market is looking beyond the short term supply glut and focus is switching to a more macro outlook and fund managers are reported to be taking a more bullish stance on many commodity markets in the face of an improved demand outlook across the globe.

- Similarly in corn the short term supply situation has been moved to the back burner and the fund net short position, unlike soybeans, could well provide further upside impetus if December futures close above the 100 day moving average at $3.55, the market is currently trading higher, and funds decide to cover.

- In wheat, as the month end approaches, we have to watch to see if the funds decide to cover their short positions, or whether they will try to defend their shorts. Doubtless Egypt’s large purchase this week has given the market a “shot in the arm” and we are witnessing the outcome right now.

26 October 2016

- Yesterday’s GASC wheat tender resulted in a purchase of 420,000 mt, by some way the largest of the season so far. Russia secured 180,000 mt, Romania the balance of 240,000 mt at $193.40/mt and $192.50/mt respectively (both basis C&F for early December shipment). By way of comparison the Egyptian season total stands at 1.6 million mt vs. 2.8 million mt last year when the average price then stood at around $209.00/mt.

- There has been a suggestion that Russia’s wheat crop may be as much as two to three million mt overstated by the USDA, which is adding a touch more support to pricing today. Consequently, our view that downside risk in wheat is limited is strengthened a notch or two today. US Gulf wheat pricing now looks comparable to Black Sea, Russia and Ukraine levels thereby limiting downside. US Gulf corn is now at a $0.10 discount/bu to Black Sea as far forward as February, which again suggests downside risk is limited.

- Chicago markets have today seen fund buyers, once again, active with the soybean complex leading the way and indeed with soybeans closing almost 2% higher. This “bounce”, for want of a better description seems all about solid demand, and the “big crop” vs. “big demand” story could well be taking a turn in favour of the demand side at this time.

- In Argentina the weather is leaning favourable for dry conditions, which will benefit planting in the coming week across the wettest areas. Meaningful rains are also forecast across C and N Brazil where frequent showers are a feature for the next two weeks. A welcome, and needed, boost in soil moisture levels across key areas of Mato Grosso, Gois and Mato Grosso do Sul is on the cards as are near to normal temperatures.

- Soybean future are close to or just above what seems to be fair value and the longer term thought process remains, namely price rallies will attract additional non-US production. Already we are hearing of price stimulated acreage expansion in spring plantings, although this is very speculative at this time. As prices rise, specifically in soybeans, we believe that there is an opening for downside unless there is a fundamental input to support a longer term bullish trend.