To download our weekly update as a PDF file please click on the link below:

Author Archives: simon

21 July 2016

- The USDA has today released its weekly export figures as detailed below:

Wheat: 477,900 mt, which is within estimates of 350,000-550,000 mt.

Corn: 851,400 mt, which is below estimates of 900,000-1,300,000 mt.

Soybeans: 1,326,500 mt, which is above estimates of 800,000-1,200,000 mt.

Soybean Meal: 201,600 mt, which is above estimates of 60,000-200,000 mt.

Soybean Oil: 20,100 mt, which is within estimates of 5,000-60,000 mt.

- This morning we saw soybeans as having bounced higher on the oversold position but with little, if any August weather threat, US corn enjoying good weather into early August and a likely 170-171 bushels/acre yield and from a wheat perspective too many key exporters facing big crops and greater volumes to export. All in all a non-bullish picture, indeed a potentially bearish picture.

- Tonight we have seen MATIF wheat futures explode to the upside with gains of €7.25/mt as European crop prospects decline once again. There are some suggesting that the European crop could be as much as 11-15 million mt below last year. However, Chicago grain markets have failed to rally on favourable Midwest weather prospects, which have limited threat at this time. Any Chicago rally looks to be limited and focussed upon wheat although in our opinion upside is somewhat limited on competitive grounds.

20 July 2016

- Lower has been today’s trade in Chicago today with fresh contract lows being seen in new crop corn, wheat and soybean futures. End users are finding prices attractive and using cheaper levels to fix prices whilst farmers are becoming somewhat reluctant to make sales at these levels. It seems that global wheat prices are easing as fund selling picks up on the back of Black Sea exporters searching for new demand.

- Many are asking when the funds will finish their soy selling as this may give a clue to a market low. China is starting to show an increased level of interest at these new lower levels. The latest Chinese import estimates show China’s soybean import volumes for 2015/16 to be 83.76 million mt rising to 85 million mt in 2016/17. For comparison purposes the USDA’s 2016/17 number is 87 million mt. The imponderable is that China will not issue opening or ending stock numbers, which makes the S&D calculation somewhat impossible.

- Nov ’16 soybeans closing below $10.21/bu suggests downside risk exists and next support at $9.85 whilst Dec ’16 corn closing below $4.46 points to lows around $4.35. Wheat futures are clearly oversold at present but pressure remains. Fund liquidation in soybeans remains the key driver at present although US export demand will likely increase as prices ease.

- Brussels has issued weekly wheat export certificates totalling 805,786 mt, which brings the season total to 1,035,593 mt. This is 61,045 mt (6.26%) ahead of last year. Barley export certificates for the week were 190,672 mt bringing the season total to 617,564 mt some 47.5% behind last season.

15 July 2016

To download our weekly update as a PDF file please click on the link below:

Our weekly fund position charts can be downloaded by clicking on the link below:

14 July 2016

- The USDA has today released its weekly export figures as detailed below:

Wheat: 317,800 mt, which is below estimates of 400,000-600,000 mt.

Corn: 1,355,600 mt, which is above estimates of 800,000-1,200,00 mt.

Soybeans: 911,300 mt, which is within estimates of 900,000-1,300,000 mt.

Soybean Meal: 187,100 mt, which is within estimates of 50,000-300,000 mt.

Soybean Oil: 54,700 mt, which is within estimates of 15,000-60,000 mt.

- Brussels has issued weekly wheat export certificates totalling 805,786 mt, which brings the season total to 1,035,593 mt. This is 61,045 mt (6.26%) ahead of last year. Barley export certificates for the wee totalled 233,483 mt, bringing the season total to 426,892 mt which is 274,586 mt (39.14%) behind last year.

- Stratégie Grains have reduced their 2016 EU soft wheat production forecast by 1.2 million mt to 145.5 million mt from a month ago.

- The Russian AgMin have forecast their 2016 wheat crop at 64 million mt.

- Chicago markets have turned lower, soybeans substantially so as they backed away from an open chart gap as latest weather updates showed the US high pressure ridge, which was expected to bring high temperatures, retrograded somewhat allowing for cooler temperatures than have been anticipated in the latter days of July. Markets are hyper-sensetive to such changes as we have pointed out previously and today’s price action is a clear example.

- US private analysts peg 2016/17 US soybean end stocks between 185-260 million bu. Our estimate is 245 million bu. Such tight stocks likely do not fully account for the potential for enlarged Chinese demand in 2016/17, but if the US lost 1.5-2.0 bushels/acre of yield due to adverse weather, it would likely push 2016/17 US soybean stocks down to 140 million bu or less, which we estimate as the bare minimum, something that is called “pipeline” in the industry. Since Brazil and Argentina are out of exportable old crop soybean stocks, world end users have really no choice but to chase the market higher if US soybean yield losses exceed 3% from trend. The US 2016/17 soybean balance sheet is fragile and there is no room for much of any yield decline due to hot/dry weather. Traders and producers understand that crops can withstand 3-5 days of hot/dry weather next week, but it’s the weather during the last week of July and opening week of August that will be so important to yield. The weekend should offer the weather models to look forward to early August with increased confidence, so we expect increased volatility early next week as the market looks forward to August. Friday’s market will be determined by the overnight and midday models heading into the weekend.

- Trading any US weather forecast beyond 12 days is a nothing more than a folly!

13 July 2016

- Today’s trade in Chicago has been all about markets digesting next week’s US temperature as the weather models continue to get warmer across the Plains. We are keeping a close eye on any pattern change to cooler and/or wetter although there is little, if any, suggestion that this will be the case through to late July. As each day passes without a shift to better rain prospects there will be a growing weather premium, which mat well be difficult to remove as time passes. On the other hand, wheat prices continue to struggle on bearish fundamental data. Egypt purchased 180,000 mt of wheat on Tuesday; prices were unsurprisingly competitive (some below replacement) as sellers search for demand and as much as 800,000 mt was offered.

- Corn’s balance sheet will be less affected by yield loss, wheat’s balance sheet is largely made and remains bearish, Russian wheat crop estimates continue to rise, but it’s soybean’s balance sheet that is most dynamic. There’s little room for yield error as the Sep-Nov soybean export program looks to be by far record large at this time.

12 July 2016

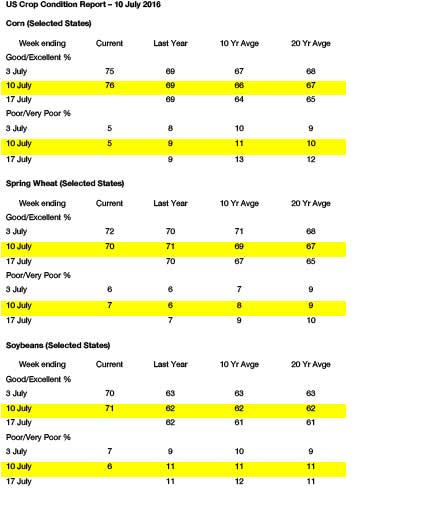

- Soybean futures tested immediate resistance at $10.70-10.80 Monday night and found selling ahead of the July WASDE report. At the close, November beans were a couple cents lower. The Crop Progress report showed a slight improvement in national crop ratings. 71% of the US soybean crop was rated as good or excellent versus 70% last week and 63% a year ago. The 2016 crop remains the 5th best rated crop on record. Crop ratings were lower in 5 states, higher in 11 states, and unchanged in 2. The best rated crop is still in WI and the lowest rated crop is in AR. Soybean exports last week were at a 13 week high, and we expect that weather worries and a strong late summer export program will continue to offer support on deep breaks. November futures should at least test $11.30-11.40 in coming weeks.

- Better than expected rains (2-4”) fell across the far N Corn Belt over the weekend, and widespread moisture worth .50-2.00” is forecast through early next week. The extended outlook still includes exceptional heat and a shift to drier weather beginning next Wed/Thurs, and we maintain a neutral outlook below $3.50. Crop conditions were boosted slightly, withgood/excellent pegged at 76%, vs. 75% last week, 69% a year ago and the highest since 1994. Notable hikes in ratings occurred in IL, MI, MN and MO. Current conditions are impressive. Another week of favourable pollination weather lies ahead, but the highest temps in years are forecast late next week and beyond. The major forecasting models end the day in mostly good agreement. The GFS is by far the warmest, but the EU and Canadian solutions also feature highs in the low/mid-90s across much of the Plains and Midwest, which places more importance on crop-finishing moisture in early August. We also mention that Gulf corn has fallen to a $10-20/mt discount to Gulf wheat, ethanol production margins are in excess of $.60/gallon through late autumn. Heat and dryness is offered to Ukraine through late July, and confirmation of a US national yield above 168 is needed to push Dec below $3.40.

- Today’s USDA reports are expected to show higher total US wheat production (and stocks) and a slight boost in global ending stocks. Until the size of the global wheat crop is fully documented, rallies will struggle. We note that Russian domestic prices continue to drift lower as harvest expands. Our sources indicate that harvest in S Russia has reached 50% complete, and yields remain better than expected. Quality is still an issue, but this will be an issue for protein premiums rather than futures price. Wheat still lacks a fundamental price driver, although corn’s reaction to next week’s hotter/drier pattern will be monitored. US spring wheat ratings fell another 2%, with good/excellent as of Sunday pegged at 70%, right at average and compared to 71% a year ago. Further deterioration was recorded in SD, where good/excellent is only 50%. Note that weekend rainfall (2-3”) across the Dakotas will help stabilise conditions. It’s still just a bit premature to call for a bottom in US/global cash markets, though seasonal lows are likely to be scored a bit earlier than normal this year. We look for a weak trend to persist in EU/Black Sea offers into late month.

11 July 2016

- The week has started lower in Chicago grains, corn and wheat, today whilst soybean are just trading in positive territory. Selling in the grains may well be linked to the USDA July report scheduled for release tomorrow. The trade is anticipating an increase in the US 2016 all wheat crop and a cut in US corn feed and residual volumes based on 3rd quarter demand patterns. Both would add to end stocks and added to the global grains situation this has triggered selling momentum, not unsurprisingly. US old crop soybean stocks will likely decline with new crop stocks holding steady on additional acres. However, the market is still attempting to reconcile weather and the possibility of a hot and/or dry August. The soybean balance sheet is somewhat more fragile than that of the grains and has limited room to accommodate any new crop supply losses.

- It feels appropriate to ease back somewhat on our bearish mentality on the worrisome weather forecast of excessive heat/dryness that starts next week. Midwest crops today are favorable with adequate soil moisture. The big question going forward is whether a more adverse weather will develop to impact as much as 10% of the US corn yield in the fill stage and have a more important impact on soybeans. The debate of good crops today and bad weather tomorrow will most likely persist into the end of the week.

- In other news today, SovEcon has increased its estimate of Russian 2016 wheat output to 66.1 million mt from 64.4 million mt previously. IKAR reported Russian 12.5% protein wheat to be priced at £165/mt, which is some $7/mt lower than a week ago, other similar reduced price levels are also noted, the progress of harvest appears to be the driver.

8 July 2016

To download our weekly update as a PDF file please click on the link below:

Our weekly fund position charts can be downloaded by clicking on the link below:

7 July 2016

- Thursday has been another “down” day in Chicago with soybeans and meal setting the pace on fund spread unwinding (long soybean short grain). It was reported that the funds were also liquidating long corn positions as well as long soybean and soybean meal positions.

- Brazil’s CONAB announced a sizeable reduction in the 2016 Brazilian corn crop with the total crop now estimated at just 69.1 million mt, down from 76.2 million in June. This compares to a crop estimate of 77.5 million mt from the USDA in June and 85.0 million mt produced in 2014. USDA pegged 2015/16 Brazilian corn exports at 22.5 million mt, which now appears to be too large by at least 5 million. Brazil’s winter corn crop was pegged by CONAB at 43.1 million mt as dire drought had an adverse impact on yield. Research argues that Brazilian corn exports will slide to no more than 17.5 million mt, which is the lowest since 2010. The export demand will flow to others including the US, Argentina and Ukraine. The USDA could easily justify raising 2016/17 US corn exports by 100-175 million bu.

- The decline in Brazilian 2016 corn production makes the sharp premium rise in fob offers from Brazil more understandable. Brazil cannot afford to export more corn or its domestic users will eventually run into supply shortages. The refilling of the Brazilian cash pipeline amid the smaller harvest will maintain sky high Brazilian corn premiums, and pull a portion of the Argentine corn crop across the border. Longer term, Brazilian farmers will be encouraged to seed additional corn acres vs. soybeans which could limit Brazil’s ability to fill Chinese soybean demand. This is likely to support November ‘17 soybeans under $9.50/bu and offer support to November 2016 soybeans below $10.25. CONAB also trimmed their 2016 soybean crop to 95.3 million mt from 95.6 million mt. The USDA June estimate for Brazil’s soybean crop was 97.0 million mt. The CONAB estimates is some 1.7 million mt lower, which is likely to come from exports. This is one primary reason why Brazil has already left the world soybean export arena.

- The sharp reduction in the 2016 Brazilian corn crop will most likely maintain robust US corn exports well into 2017. In fact, the fear is growing that US export elevations to ship out large tonnages of corn and soybeans will become strained during the harvest period. Yet, funds are still too long and liquidating length amid bearish chart based patterns. Our view is that on price breaks it would be prudent to shift from a bearish to more neutral Chicago view.