- The USDA has today released its weekly export figures as detailed below:

Wheat: 465,300 mt, which is within estimates of 400,000-600,000 mt.

Corn: 1,421,000 mt, which is above estimates of 950,000-1,400,000 mt.

Soybeans: 1,322,100 mt, which is within estimates of 1,000,000-1,500,000 mt.

Soybean Meal: 186,600 mt, which is within estimates of 150,000-370,000 mt.

Soybean Oil: 17,600 mt, which is below estimates of 20,000-50,000 mt.

- Brussels has issued weekly wheat export certificates totalling 585,153 mt, which brings the season total to 32.435 million mt. This is 46,541 mt (0.14%) behind last year.

- Early strength in soybeans gave way to weaker soymeal prices and soybeans were in the red by the close on Thursday. Old crop meal again marked a new low for the month, while new crop December slipped to a three week low. Soybean export sales were within expectations at 660,690 million mt, taking annual commitments to 49.9 million. Export commitments are now at 105% of the USDA forecast, and just under last year’s record. Given recent sales announcements, commitments will again swell next week, and the USDA will likely increase their annual estimate in the July WASDE. The Argentine AgMin lifted their soybean crop estimate to 58 million mt while the BAGE held their estimate steady at 56 million. Regardless of the actual output, fob offers suggest that exportable supplies are nearly sold out. November beans have easily traded through support at $11.20, with the next target at the May WASDE report high at $10.80 and then the 50-day moving average near $10.60. Confirmation of another 2-4 million soybean acres could produce a deeper correction to $10-10.40, unless weather intervenes.

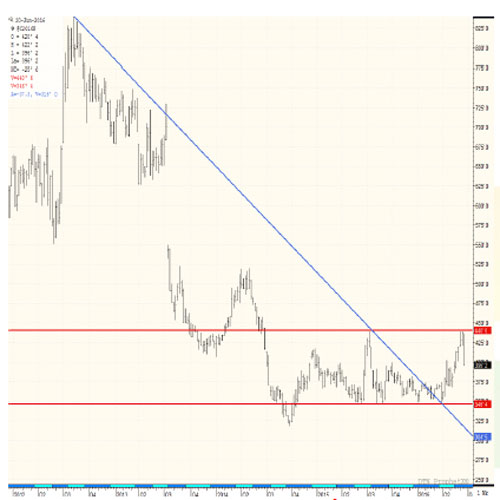

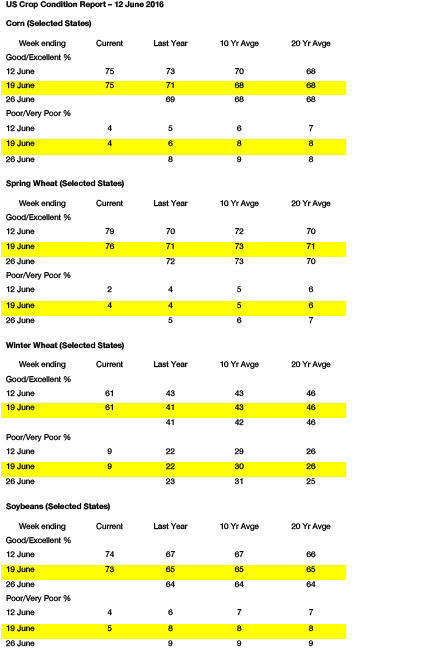

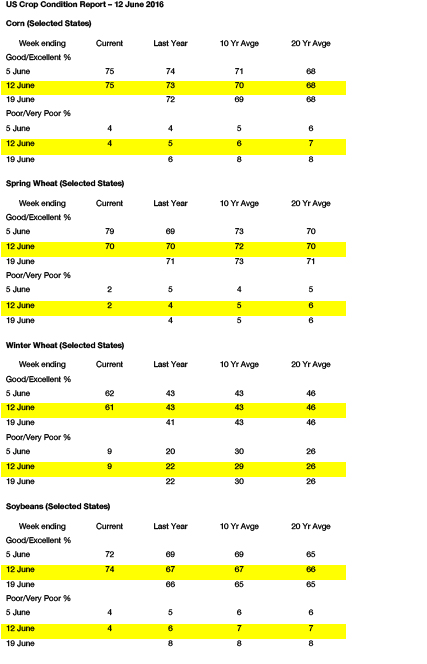

- Chicago corn futures fell another 5-6 cents as recently added long positions were unwound. On the week corn is down 50 cents! This is the largest weekly decline since the summer of 2013. Weakness in world wheat cash market (recall the wheat’s bearish seasonal is just starting), and the potential for above-trend yields has produced a dramatic change in market sentiment. A week ago, demand rationing was being discussed; today the market is searching for demand. US export sales through June 16th totaled 34 million bu, down 1 million from last week and down 25 million from early June. As US Gulf corn’s discount narrowed vs. other origins, sales slowed, and Gulf corn is now priced above EU/Black Sea milling wheat as well as Argentine corn for Aug/Sep. Argentine crop estimates are rising as more of the crop is gathered. A further slowdown in US corn exports is anticipated. Corn has now all but confirmed a seasonal high and the trade no longer expects that the summer of 2016 Midwest weather will mirror the drought years of 1983, 1988, or 2012. Selling rallies appears to be the order of the day right now.

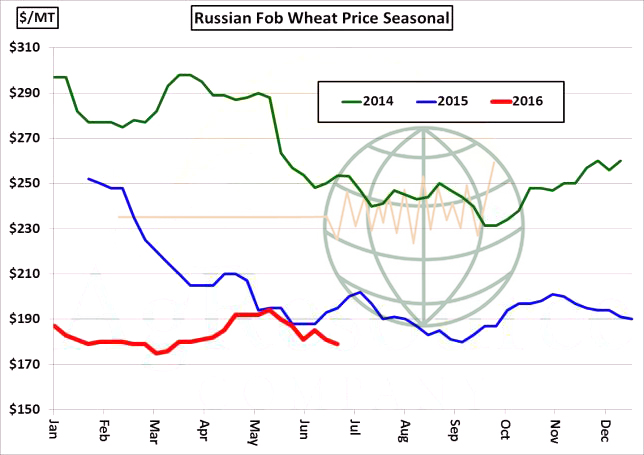

- US wheat futures continue to reel from improving US weather ahead of corn pollination. Wheat already was looking for better US feed consumption, and the drop in corn futures and cash prices will make this chore more difficult through the first half of the crop year. Global cash prices fell again, Argentine wheat planting has reached 46% complete, and will expand rapidly with soybean harvest winding down, and still there’s a noticeable lack of interest from major importers. US export sales through the week ending June 16th totaled 17 million bu, down 11 million from the previous week and slightly above the pace needed to meet the USDA’s forecast. The pace of sales is likely to slow as more of the N Hemisphere’s wheat crop is harvested in July and August. Russian hi-protein wheat for Aug/Sep delivery is down to $178-179/mt, French soft wheat is offered at $184-186/mt, down $1 from Wed. Following today’s break, US Gulf wheat is quoted at $193-195/mt for August and beyond. Any lasting rallies hinge solely upon heat/dryness in July, which is now looking unlikely.

- Friday’s trade will doubtless be macro driven on the back of the Brexit vote and all that it implies. The FTSE 100 index has dropped 611 points (9.6%) overnight and £Stg is 1.3233 vs.US$ down from 1.5007 last night (12% down), a level not seen since 1985. Markets are set for a day to equal or even beat the infamous Black Wednesday and Lehman Bros crisis. Fasten your seat belt and hang on – it’s bound to get wild!