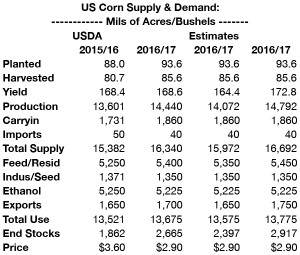

- The soy markets have soared this afternoon in the wake of lower than anticipated stocks and cautious cuts in 2016 S American output, also what seem to be suspiciously low old and new crop Chinese soybean imports. Clearly those shorts in soybeans are “at risk” is any US crop adversity should prevail.

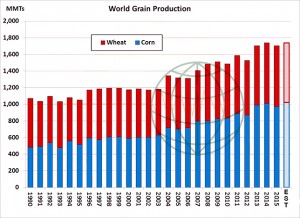

- On the other hand the wheat outlook is doubtless bearish with the US winter crop, 2016/17 US stocks and global 2016/17 stocks all above expectations. The 2017 Russian crop at 63 million mt vs. 61.4 million mt last year may be ambitious whereas the EU crop at 156.5 million mt (160 million mt last year) looks on the low side given current weather. We would expect an upward revision in the US wheat crop in June and/or July reports.

- The report can only be viewed as bullish and algorithm based trading kicked in – big time – in the immediate post release period taking the soybean market more than 5% higher, hitting fresh rally highs. Corn and wheat followed with some sympathy and it is reported that volume has been huge! The “spike” higher will either be a season peak – or not! A truism if ever we saw one, but the Midwest summer growing season will be a key driver of that!

- One outcome will be that the funds will be encouraged to hang on to their longs until such time as they are proved wrong, and this will be dictated by the market or N Hemisphere weather as time moves on.

- Clearly price and market action is bullish, however it seems that the actual data is little changed from expectation. Global 2016/17 wheat stocks are record large at 257.3 million mt, up 14 million from the current year, and world 2016/17 corn stocks will also be large and equal to the current year’s 208 million mt. Such stock levels should limit price upside. World 2016/17 soybean stocks declining 6 million mt to 68.21 million still leaves plenty of soybeans in the world.

- We now have to live with the current position until such time as we have a better handle on N Hemisphere crop potential in June or July. Doubtless wheat and corn balance sheets are bearish but all eyes are on soybeans today, and they are propping up everything right now, the grains should be lower on basic raw data today!

- We will continue to ponder and pontificate overnight.

To download our USDA recap please click on the link below: