- We saw US winter wheat crop conditions pegged at 59% good/excellent, which was considerably above expectation and some 15% above this time last year. Prices have reacted accordingly with Chicago wheat futures some 10 cents (2.2%) lower on the day. There is additional confidence that forecast rains will fall and ease the dry conditions that have added recent weather premium, and it also feels that lower US wheat yield forecasts are a touch early too and more evidence of loss/damage is required to substantiate early rumours.

- Informa Economics have released their latest S America 2015/16 crop estimates as follows:

Argentina corn 27.5 million mt, 500,000 mt above last month.

Argentina soybeans 59.5 million mt, 500,000 mt above last month.

Brazil corn 83.7 million mt, 1.2 million mt above last month.

Brazil soybeans 100.5 million mt, 800,000 mt below last month.

- The soybean complex has gained today on the back of crude oil price rallying with wheat lower on better than anticipated US crop conditions and corn has been caught between the two.

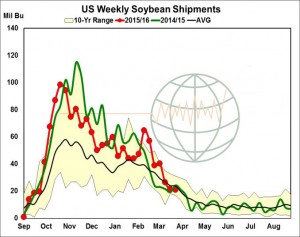

- It is interesting to note that Brazilian export commitments for the first week of April are record large, US exports declining as a consequence?

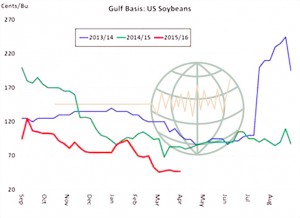

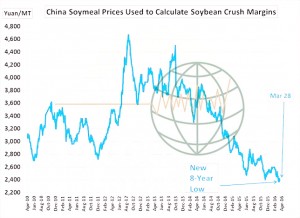

- The soybean complex continues to reel from oversold territory in late February, but buying interest is beginning to wane. There is no need for additional acres in the US, and it is difficult to be overly bullish on export prospects amid record S American crops. More important that record Brazilian shipments nearby is that S American soybean exports are expected to be extended into the gut slot of the US harvest. The top end of a trading range is being formed in soybeans and we look for lower levels going forward.