- Yesterday Informa Economics released their latest 2015/16 production forecasts for S America with Argentine corn output increased to 26 million mt from 22 million previously. Argentine soybean production is also higher at 60 million mt, an increase from 58.5 million mt. Brazil’s corn output is forecast higher at 81.6 million mt from 81.3 million previously. Soybean output in Brazil was reduced to 100.5 million mt from 101.4 million.

- Conab, for comparison purposes, put Brazil’s corn crop at 83.3 million mt, 1 million higher than a month ago, and the soybean crop at 100.9 million mt, 1.2 million lower month on month but this would still represent a record output if reached.

- To conclude the raft of data today, StatsCan reported 2015 year end wheat stocks at 20.7 million mt, below trade estimates of 21.8 million and last year’s 25.6 million mt. Canola (rapeseed) stocks were reported at 12.1 million mt, above trade estimates of 11.5 million but below last year’s 12.6 million mt.

- The USDA has today released its weekly export figures as detailed below:

Wheat: 154,000 mt, which is below estimates of 200,000-400,000 mt.

Corn: 1,143,500 mt, which is above estimates of 800,000-1,000,000 mt.

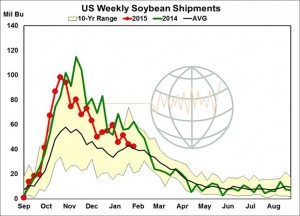

Soybeans: 22,100 mt, which is below estimates of 400,000-600,000 mt.

Soybean Meal: 12,800 mt, which is within estimates of 5,000-25,000 mt.

Soybean Oil: 12,800 mt, which is within estimates of 5,000-25,000 mt.

- Brussels has issued weekly wheat export certificates totalling 826,594 mt, which brings the season total to 17,019,839 mt. This is 707,143 mt (5.99%) behind last year. The last couple of weeks’ volume are about on pace to hit the USDA’s latest 32.5 million mt season total, but need to be matched each and every week for the remainder of the season if the total is to be hit.

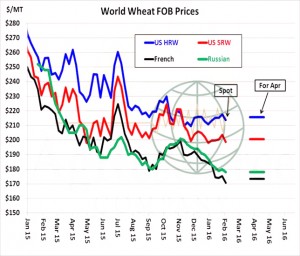

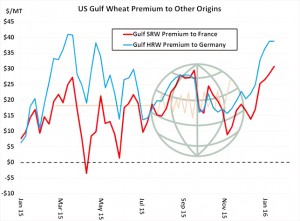

- Chicago’s early rally faded as wheat led the way lower in the wake of what was described as “disappointing” price results from Algeria’s tender and ongoing weakness in global fob levels. Despite the fall in the US$ prices in Chicago closed lower pretty much across the spectrum. The US$ has lost around 3% this week as bullish trades are unwound amid concern that US payrolls will reflect post holiday weakness, which will likely place interest rate hikes on hold. The fear that a continuation of stuttering global economic outlook will drag US GDP lower is the cause of bullish US$ trade being unwound. Algeria’s tender was concluded at a reported $178 basis CIF and is thought to be mainly French origin although there has been a suggestion that UK origin may feature. The price works back to a fob level equivalent to $171-172, which is a multi year low and below current replacement levels, perhaps indicating eagerness to book volume sales ahead of the 2016 harvest.

- The news of the Algerian price has many wondering if EU wheat will cost into Mexico and SE USA as a feed ingredient. The feeling is that at a $1.50/mt premium for wheat over US corn, and its improved feeding value, will attract interest from US livestock feeders. Little wonder US Gulf corn is losing export demand!

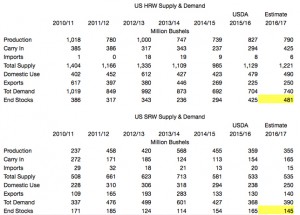

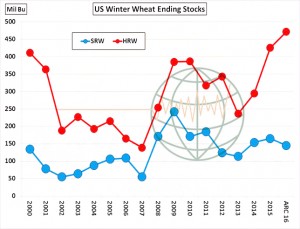

- Price trends in US markets has been broadly sideways for some three weeks but global wheat prices are continuing lower as too much supply chases too little demand. Next week’s WASDE report should see US export volumes trimmed on corn and wheat and reduce 2015/16 soybean crush leaving elevated end stocks, and the outcome should be lower prices. We are watching price rallies failing well below technical resistance levels suggesting that physical sellers rather than technical chartists are running the market at present.