- Chicago markets are higher as we write this, wheat sharply so amid what has been described as “macro inspired” trading. Today’s highlight has been the surging value of the €uro, which followed a disappointing ECB rate cut by Mario Draghi (ECB leader), which in turn saw the US$ plunge to four week lows.

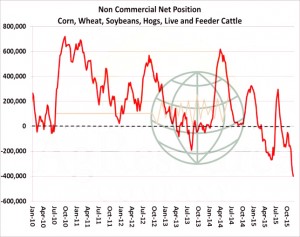

- It is estimated that the non-commercial short in Chicago wheat stands at 100,000 contracts compared with the record set last May at 110,000 contracts. It is these positions that are being covered at present – do not forget both Chicago and Kansas wheat futures were at contract lows yesterday and the power of a short covering rally should not be overlooked (have we mentioned this previously?)! Corn has followed and soybeans are also higher despite largely favourable S American weather forecasts and weaker than expected US export sales.

- It is our opinion that the US$ will remain strong, recall US$ rallies tend to be long-term affairs, and the current issue is how deep will the current correction be. There was an expectation of an ECB rate cut of as much as 0.2%, and the actual cut of 0.1% caught traders off guard hence the sharp exchange rate move that followed.

- Crude oil has rallied $1.60/barrel with gasoline and ethanol also higher.

- The USDA has today released its weekly export figures as detailed below:

Wheat: 432,900 mt, which is within estimates of 250,000-500,000 mt.

Corn: 499,400 mt, which is below estimates of 500,000-1,100,000 mt.

Soybeans: 878,300 mt, which is within estimates of 800,000-1,200,000 mt.

Soybean Meal: 77.500 mt, which is below estimates of 150,000-300,000 mt.

Soybean Oil: 5,300 mt, which is below estimates of 10,000-25,000 mt.

- For their respective marketing years to date, the US has sold 672 million bu of corn, down 25% from last year; 1,211 million bu of soybeans, down 17%; 532 million bu of wheat, down 14%; 5.4 million mt of soybean meal, down 20%; and 498,000 mt of soybean oil, up 40% from a year ago. The discrepancies from year-ago levels are generally unchanged from recent weeks. No new sales were announced by FAS this morning.

- Brussels has issued weekly wheat export certificates totalling 1,109,556 mt by far the largest week so far this season and nearly double last week’s figure. This brings the season total to 10,762,381 mt, which is 1,996,455 mt (15.65%) behind last year. To reach the USDA’s latest EU wheat export total of 33.5 million mt it will be necessary for exports to hit an average of just over 710,000 mt for each of the remaining 32 weeks in the season.

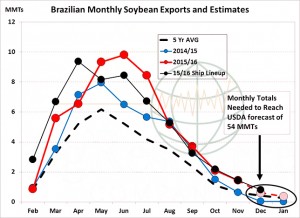

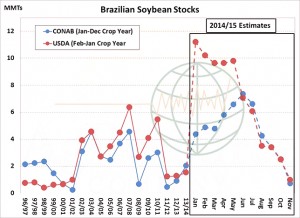

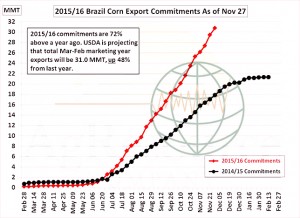

- Informa Economics has raised its estimate for Argentine 2015/16 corn output to 21 million mt from 18.5 million previously.Their soybean estimate is down by ½ million mt to 58.5 million mt. Argentina last year produced 26.5 million mt of corn and 60.8 million mt of soybeans. 2015/16 Brazilian soybean output is revised higher at 101.4 million mt, a 400,000 mt increase whilst 2015 all corn output is trimmed ½ million mt to 81.3 million mt. Last year’s Brazilian output saw soybeans at96.2 million mt and corn at 85 million mt.

- Historically, year-ends tend to be price supportive and with relatively high fund net short positions this year look very vulnerable to spikes higher as position size is reduced. Today’s US$ drop may well have provided the trigger for a short covering spree. However, global fundamentals still show that the wheat market in particular, and others somewhat less so, are weighed down by huge surpluses and limited buying interest. Unless we see a significant crop damaging or restricting weather event we would expect a resumption of price pressure and believe that rallies will provide selling opportunities.