To download our weekly summary as a PDF file please click on the link below:

Author Archives: simon

18 September 2015

To download our weekly update as a PDF file please click on the link below:

Weekly Update 18 September 2015

Our weekly fund position charts can be downloaded by clicking on the link below:

17 September 2015

- The USDA has today released its weekly export figures as detailed below:

Wheat: 510.700 mt, which is above estimates of 275,000-450,000 mt.

This year 377,500 mt; Next year 133,200 mt.

Corn: 533,000 mt, which is within estimates of 400,000-600,000 mt.

This year 533,000 mt; Next year zero mt.

Soybeans: 912,8 mt, which is within estimates of 900,000-1,300,000 mt.

This year 912,000 mt; Next year 800 mt.

Soybean Meal: 239,500 mt, which is above estimates of 100,000-230,000 mt.

This year 41,000 mt; Next year 198,500 mt.

Soybean Oil: 12,800 mt, which is within estimates of zero-20,000 mt.

This year 12,800 mt; Next year zero mt.

- Brussels has issued weekly wheat export certificates amounting to 562,017 mt, the best figure since five weeks ago. This brings the season total to 4,602,268 mt, which is 963,035 mt (17.3%) behind last year.

- The market has been somewhat sluggish and uninspiring today as many are awaiting the Fed’s latest rate announcement after some nine years of unchanged rates. Many are anticipating rate rises, the only question being when and it seems we are about to find out very soon! Any rate rise will likely impact the US$ making it stronger and thereby further pressuring commodities lower.

- The bulls were less than impressed with today’s sluggish US export figures and markets are approaching the close in negative territory. Soybeans are following the grains lower as early Midwest yield data is coming in well above producer expectations. There are even some commentators questioning whether or not we could see a record US yield this year. As prices slip ever lower, close to contract lows once again, there is no sign of consumer interest ramping up in any significant manner.

- It has been reported that Russia is expected to decide on Saturday whether or not to alter their wheat export tariff. Seemingly the AgMin favours a reduced level of tax whereas the Treasury does not, which could pose something of a rocky ride for any change to be agreed.

- StatsCan have reported their latest monthly crop output estimates, and spring wheat is forecast 430,000 mt higher at 18.4 million mt, some 13% behind last year whilst canola (rapeseed) is forecast 1.1 million mt higher at 14.4 million mt, down 11.6% from last year.

- Closer to home Stratégie Grains forecast the EU soft wheat crop at 147.5 million mt, an increase of a further 3.5 million mt month on month a mere 1% down on last year. In contrast the EU corn crop was reduced a further 2.3 million mt month on month to 57.4 million mt, a full 24% down from last year.

16 September 2015

- We have had a confusing day with the FSA releasing incorrect Farm Program Participation data, which initially suggested that the prevent plant acres would drop 2 million from August – highly unusual to say the least. A further release informed the market that initial figures were incorrect and would be updated later in the day. The error, and subsequent correction, have left a bad taste and mistrust along with a variety of participant reaction.

- For what it is worth, this is nor the first time that the FSA have issued erroneous data. The 2008 information was incorrect and WASDE had to re-release its monthly report after the FSA reissued their figures. Last year the FSA released data early and this year, the encrypted data, was once again incorrect. Many in the trade are questioning how this could possibly be the case and asking how any reliance can be placed upon future releases.

- Regardless, the corrected data showed US corn program acres at 84.3 million acres, soybeans at 80.7 million acres and wheat at 52.3 million acres. The corn and soybean FSA program acres were very close to last year’s totals. Based on the data, Research argues that US corn acres could hold steady or rise 250,000 acres in the October report while US soybean seeding fall 250-500,000 acres. US prevented plant acres were 6.57 million acres. But as we all learned last year, FSA Program data is just a tool in the box of NASS for seeded acreage and they will continue to also rely on their own surveys.

- Black Sea fob wheat, corn and feed wheat prices are steady to weaker again this morning. Ukraine feed wheat was offered at $170/mt and bid at $168/mt with no trade. The world feed wheat market continues to decline in search of demand. Ukraine and Black Sea feed wheat is now priced at parity or a slight discount to corn – even though its feeding value holds an advantage. US Gulf corn is offered at $179/mt or at a small premium to Black Sea feed wheat/corn. With Ukraine and Brazilian corn falling in price this week, the US corn market has to become more competitive to garner new trade demand. This along with harvest pressure is lowering Chicago values.

- Midwest soybean yield reports have been mixed, and the trade appears to be waiting for additional harvest results before passing judgment on final US soybean yields. Early planting is expanding rapidly across N Brazil with estimates that more than 2 million acres have already been seeded. Adequate soil moisture favours germination. These beans will be cut in January and Chinese crushers are not chasing the recent price uplift.

15 September 2015

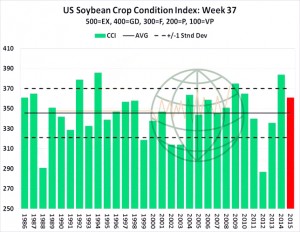

- US soybean crop ratings, issued last night, inched lower with good/excellent down 2% at 61%. As noted in the chart, the overall condition of the crop remains well above average. 35% of the crop was reported as dropping leaves versus the 5 year average of 31%. Harvest in the far south is running slightly ahead of average, and starting to move into the S Midwest. NASS will begin reporting national US soybean harvest progress next week. The FSA Crop Participation report on Wednesday could offer a bullish surprise and set the next soybean selling opportunity. We would see any rally in November soybeans to $9-9.25 as a potential sale at this time, and we see the market caught in a $8.50-9.25 range.

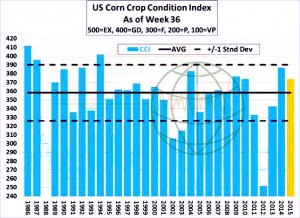

- Good/excellent US corn condition ratings were unchanged this week at 68%. Ratings boosts in IN, IA, PA and WI offset losses in KS, MO, NE and NC – conditions have countered the seasonal downward trend once again this year. The crop is 35% mature, vs. 25% a year ago, and is 5% harvested, vs. 4% a year ago. Progress will accelerate in the weeks ahead amid a lack of widespread rain and abnormally warm temps. Early yield results have been highly variable, but it’s far too early to establish a US trend, and key will be actual data from the Western Corn Belt, which is expected in the next two weeks.

- US winter wheat planting progress as of Sunday reached 9% complete, on par with the five-year average but below last year’s 11%. Spring wheat is 97% harvested, above last year’s 72% and above the five year average of 86%.

- Chicago has seen the grains, corn and wheat, ease a touch and soybeans holding onto recent gains in advance of what many expect to be bullish FSA crop participation estimates tomorrow. There may be a further push higher in soybean and product prices on release of figures, but if the data does not justify a decline of a million acres or more , we would expect a widespread decline in prices. There is a widening gap between world grain and soybean fob prices and US levels, which the US can ill afford as their export volumes are already struggling compared with previous years

- Perhaps more specifically, Black Sea fob wheat, corn and feed wheat prices are steady to weaker from last week, totally ignoring the recent Chicago price rally, yet still struggling to find demand despite the lower prices. French export silos are reported to be full and global grain markets continue to fail to uncover fresh demand. It is reported that SE Asian consumers have cover well into early 2016. The current lack of Black Sea price uplift in corn and wheat could well suggest that the rally in Chicago may be short lived. As always, time will tell.

14 September 2015

- Chicago markets started the week sharply higher on fund buying and new spec purchasing. Corn has moved above its 20 day moving average which triggered further buying. Soybean markets have also moved up on additional Chinese market pricing and we could be looking at further gains into midweek when FSA data is published.

- News of freezing weather in Brazil, which is suggested to cause damage to wheat crops in Parana, RDGS and Santa Caterina lent support to wheat markets although it will likely take a few days to fully asses the true level of any damage. Early estimates are putting damage at 20-50% of yield potential – although it must be reiterated that this is only an early estimate. December Chicago futures have rallied back to resistance levels although not through them – yet!

12 September 2015

Our weekly fund position charts can be downloaded by clicking on the link below:

Our September USDA report summary can be downloaded as a pdf file by clicking on the link below:

11 September 2015

- It is probably fair to say that today’s report has come and gone with little in the way of statistical fireworks and prices have been little changed from earlier in the day.

- Primary data, which the market has been trading, is a reduction in corn production and a boost in 2015/16 soybean output. Soybean yield was increased a touch to 47.1 bushels/acre vs. 46.9 in August with a corresponding increase in output. Corn yield was reduced to 167.5 bushels/acre vs. 168.8 in August, again impacting overall output. Wheat was left pretty much unchanged as NASS will update final wheat figures in the 30 Sep small grains report.

- US corn end stocks were reduced to 1,592 million bu, down 121, month on month due to reduced production and reduced carry in stocks, old crop exports boosted a touch with surprising July shipments and increased ethanol use. New crop demand was unchanged.

- 2015/16 soybean end stocks were reduced 20 million bu as a function of reduced carryin. Old crop crush was raised and exports also grew and old crop stocks fell 30 million bu month on month. With reduced carryin overall new crop supplies fell slightly.

- US wheat stocks grew 25 million bu with a like for like reduction in exports. Finally the USDA could not ignore cheaper FOB offers from around the world into early winter.

- Overall the numbers were uneventful. Ear and pod weights will doubtless be debated into the more relevant October report. Longer term price direction will focus closely upon US export numbers and competitiveness. Given current wheat and corn US Gulf basis levels it does to look bullish right now. Global currencies, higher non-US acres and potentially ongoing El Niño will likely weigh on longer term market direction.

- We continue to favour selling decent price rallies.

- Our recap of the report in pdf format can be downloaded by clicking on the link below:

10 September 2015

- Thursday was a quiet session in Chicago ahead of Fridays USDA release with few willing (or brave/foolhardy?) enough to take on new risk or position in advance of yield updates. Average trade estimates have drifted closer to the NASS August figure making market reaction Friday difficult to predict. Regardless, we continue to believe that any supply driven rally will crete a sales opportunity.

- The Brazilian Real has collapsed to a 13 year low in the aftermath of S&P downgrading their bonds to junk status and the prospect of an exchange rate of 4:1 vs. US$ is looking more of a possibility. Spot soybeans priced in Real are now up 35% from a year ago compared with spot soybean in US$ which are down 20%. The comparison is equivalent to $14/bu soybeans, which will likely more than offset cost of production. Acreage expansion looks highly likely and the USDA’s 3% growth projection could well be too low in the face of the present currency fluctuations.

- EU wheat export licences reached 368,257 mt this week which brings the season total to 4.04 million mt. This is 814,000 mt behind last season (or 83.23% of last year’s exports). World exporters, as well as those in Europe, are struggling to find fresh business. There is no word from Russia on their wheat export tariff revisions – if any. US weekly export figures are to be released later on Friday, a day later than usual, on account of the Labor Day holiday.

9 September 2015

- Chicago markets appeared unable to sustain early gains and what looked to be a developing overnight rally. Outside markets were a touch negative with crude some $0.70 lower and the US$ a touch higher. Russian and Brazilian currencies hover around multi-year lows and Monday night’s crop condition ratings did little to encourage the bulls in advance of Friday’s report.

- It is rumoured that Chinese soybean crushers are struggling for credit lines, not the first time we have heard this, but it is weighing on traders’ views on imports looking forward.

- A wet pattern is forecast for S and C Brazil in the next ten days. Unlike last year, it is not expected that plantings will be delayed due to dryness, and normally seeding starts 15 September. Activity is expected to be brisk in the second half of the month.

- Egypt has announced it will extend its wheat moisture level into spring 2016, which will give greater opportunities to vendors in its tenders. EU origins, particularly France, are expected to see better volume trade as a result, however we would expect to see Black Sea competitiveness override, at least in the next month or so.