- It has been a low volume morning with initial limited interest from fund traders. Chicago in the reopen, came under pressure, tried to bounce before more aggressive selling then pushing values down to new daily lows. Volume today is down some 15-25% from recent weeks.

- Chicago lacks any “upside spirit” with traders expecting that US corn and soybean crop ratings improve later this afternoon by 1-2% in the good/excellent category following last week’s rainfall. Chicago traders need to see a statistical reason that US corn/soybean yields are well below NASS to engender a late summer market bounce.

- The Pro Farmer Tour this morning indicated that Dakota crops are behind normal, but they are generally healthy depending on the length of the growing season.

- We would note that you cannot trade a frost/freeze risk until it shows up in the10-14 day forecast. The earliest that such concern could arrive is mid-September or about a month away. The market knows that crops are delayed in maturity, but it has no way of measuring what it might or might not mean to lost production or yield.

- Chicago brokers estimate that funds have sold 2,600 contracts of wheat, 3,200 contracts of corn, and 2,700 contracts of soybeans from the reopen. In soy products, funds have sold 3,100 contracts of soyoil and 1,100 contracts of soymeal. Funds are modest net Chicago sellers this morning, but the volume does not suggest any real passion by the bulls or the bears.

- US export inspections for the week ending August 15 were; 20.0 million bu of corn, 42.6 million bu of soybeans, and 18.0 million bu of wheat. China shipped out 20.3 million bu of soybeans or nearly half the US’s weekly total. China has some 103 million bu of us soybeans that are sold, but not shipped in an old crop position. US soybean weekly exports are expected to “stay bright” for a few more weeks as China adheres to its pledge to execute Government purchases of US soybeans. US vessel nominations to load out to China are staying strong.

- For their respective crop years to date, the US shipped out 200 million bu of wheat (up 40 million or 25% from last year), 1,817 million bu of corn (down 353 million or 16%), and 1,597 million bu of soybeans (down 409 million or 20%). The export pace heading into the end of the crop year smacks of a slowing trend for new crop amid cheaper S American, Black Sea and Romanian grain offers. The US is the most competitive in soybeans by a wide margin, yet it can only fill non-Chinese demand based on the prevailing US/China trade war.

- Black Sea wheat prices are sliding to start the week with values down $2-3 with offers at$192/mt for September and there being few bids.

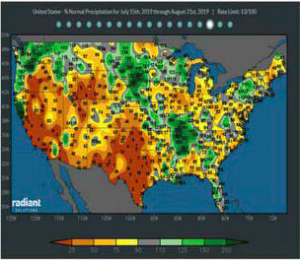

- The GFS midday weather forecast is wetter across the southern half of the Midwest/Delta and drier across the N Plains and the NW Midwest than the overnight run. Some 1-3.00″ of rain is forecast to drop across the south of I-80 with 0.25-1.25″ of rain to the north. No extreme dryness or heat is foreseen for the Midwest or Northern Plains. Portions of Texas will be hot with highs ranging from the mid 90′s to the lower 100′s under a high-pressure ridge. This ridge retrogrades westward by next week allowing for mild temperatures and several rain chances. There is no evidence of any threatening cold weather into Sept 3. The Central US forecast is generally favourable into the US Labor Day holiday.

- Immature crops are the early theme of the Pro Farmer Crop Tour, but the market has no way of knowing whether a frost/freeze will be early, timely or delayed this autumn. Chicago will make maturity adjustments when frosty temperatures are seen on the forecast maps. Until then, Chicago will see improved yield/production potential amid the recent rain. It is all about getting confidence over 2019 US corn/soy yield potential which is likely to cause a range bound Chicago market into September.