- The weekly Commitment of Traders report showed that in the primaryChicago ag markets, funds held a net long position worth 353k this week versus 406k last week, and -137k year ago. Fund sold 19,800 corn, 20,500 wheat, and 12,700 soybean contracts. Also of note, was liquidation of close to 12,000 soybean meal contracts and 14,303 contracts in the cattle market.

- Overnight selling in Chicago soybean markets uncovered strong end user demand in the meal market, that lifted old crop contracts $8-9/ton. Soybeans finished just below unchanged, but found technical support at the 100 day moving average and finished more than 18 cents above the early morning low. Funds were sellers early and buyers late. The weekly US export sales report was mildly disappointing within the context of a week’s data, and was the lowest in four weeks. However, slowly, the pace of shipments/sales and the USDA’s export forecast have started to come in alignment. The shipment pace is 11% behind last year, though total commitments are now within 4 million mt of last year’s record. Outstanding sales at 9.8 million mt are the largest mid-March total ever, and nearly 2 million above a year ago. The USDA’s March forecast now looks to be reasonable. Argentine exports are expected to fall to fall under 1 million mt as crop estimates are now under 40 million mt, and US export shipments are expected to pick up mid summer, as the Brazilian export program winds down. We look for narrowing ranges next week ahead of the March NASS report, but breaks under $10 should find good support ahead of the US growing season.

- Heavy selling overnight and in the morning faded into end user pricing as, US-China relations aside, fundamental remains mildly bullish. Plains drought will deepen over the next two weeks, the USDA looks to raise old crop exports further, and cattle on feed continues to expand to multi-year highs. Anxiety over global trade barriers will persist for some time, but otherwise the risk of tightening old and new crop balance sheets remains intact. Export sales through the week ending March 15th totaled 58 million bu, vs. 99 million a week ago but still sizeable. Another two weeks of similar demand, and the USDA will be forced to raise its export forecast 25-50 million bu. Amid unchanged production in Mexico, and a final Argentine crop between 30-32 million mt, it is unlikely that new crop exports fall below 2.0 billion bu. However, fund length is still very large, with managed funds on Tuesday long a net 213,000 contracts, down only 30,000 on the week. Funds will very likely defend this position into early summer, until crop conditions are known, but we maintain that rally efforts will be more laboured in the weeks ahead. We also maintain that above-trend N Hemisphere yields are now needed to turn bearish.

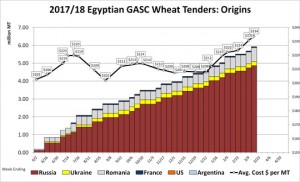

- Wheat extended its recovery today, and Kansas’s premium to Chicago is back to $.22/bu, basis July. It has become apparent that early-week rain in parts of the HRW Belt did little to alter soil moisture there, and near complete dryness will resume across W KS, E CO and the TX/OK panhandles in the next ten days. KS crop ratings are published on Monday afternoon are likely to be only marginally improved. Otherwise, fresh wheat-specific new is lacking. Russian interior prices this week are unchanged, and amid ongoign weakness in Russia’s Ruble replacement costs in S Russia in US$ terms are rather weak. However, contacts hint that supplies are nearing exhaustion in areas near ports, and exporters are now having to search farther inland to meet current loading contracts and commitments. US weekly export sales totalled an uneventful 10 million bu, still slightly below the average needed to meet the USDA’s forecast with just ten weeks remaining in the 2017/18 crop year. Surprisingly, managed funds are long a net 30,000 contracts in KS, up 600 on the week and the most since 2014. An outright bull trend requires adverse weather in the EU/Black Sea, particularly amid fund length in HRW futures, long term forecasts are dry across the Plains.

To download our weekly update as a PDF file please click on the link below:

Weekend summary 23 March 2018

Our weekly fund position charts can be downloaded by clicking on the link below:

Fund positions disaggregated data