- The Chicago morning started off with fresh fund buying on bullish technical considerations in corn and soybeans. Stronger than expected weekly US corn and soybean export sales added to the tailwind of support. The wheat market declined on slow US sales amid the sinking EU wheat market. The EU is trying hard to boost its wheat export pace amid large stocks. We look for a mixed Chicago close with March wheat to find resistance above $4.30 with March soybeans uncovering selling above $9.835, the 50 day moving average, with S American weather forecasts being closely followed. A close today above $3.52 March corn (50 day moving average) or $9.79 in March soybeans (200 day moving average) would be deemed as bullish. The wheat market looks to hold in a broad range amid large world exporter stocks.

- Chicago brokers report that funds have bought 3,500 contracts of corn and 4,300 contracts of soybeans. In soy products, funds have sold 3,700 contracts of soyoil while buying 2,900 soymeal. Funds have sold 3,200 contracts of wheat.

- There is optimism that next week’s NAFTA negotiations will yield positive results, and that at a minimum, kicks the negotiating can down the road with future negotiations. The NAFTA trade talks look to be starting two days early amid the expectation that Canada will bring a new plan to the US and Mexico. The market could see this as being supportive next week.

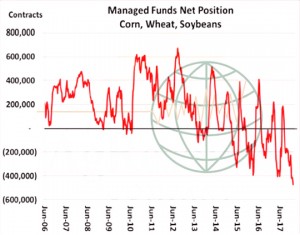

- Seasonal price trends are up and funds are too short of corn, wheat and soybeans amid concerning S American weather. Our hope is that NAFTA negotiations can make progress next week that will help US corn values. China should be a larger buyer of soybeans ahead of their Lunar New Year.

To download our weekly update as a PDF file please click on the link below:

Weekend summary 19 January 2018

Our weekly fund position charts can be downloaded by clicking on the link below:

Fund positions disaggregated data

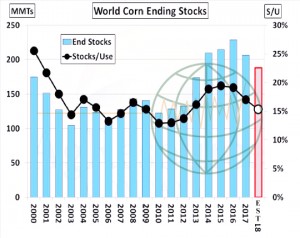

- Funds have entered into a new record short ag futures position of -473,000 contracts, an increase of 29,000 contracts in the holiday shortened week. The net short in US soybeans surged to -103,400 contracts with the combined grain (Chicago corn and wheat) at -370,000 contracts. The hefty fund short opens upside price risk should any bullish supply shock develop. World farmers have to be sellers of supply if Chicago prices are to be pressured substantially in the weeks ahead.

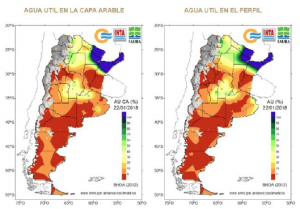

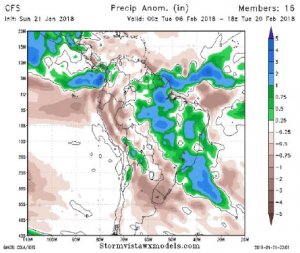

- Following higher overnight trade, soybeans and meal extended the week’s gains through Friday, with soymeal again pacing the rally. The Argentine weather forecast shows limited rainfall over the next 10 days which is likely to keep planting progress to a minimum and stress growing crops. Commodity funds were estimated buyers of; 5,000 soybean and 3,500 soymeal contracts, while selling 2,600 contracts of soyoil. IMEA, an agriculture economic institute in Brazil, estimated that soybean harvest progress in Mato Grosso had reached 3% this week versus 12% last year and the 5 year average of 7%. Planting this year was later due to dry October conditions, which has also pushed the harvest backwards. Of note is that the export lineup update shows 1.8 million mt of beans scheduled to sail in January versus 1.2 million a year ago. We expect Chicago meal and soybeans to add premium until there is a change in Argentine weather forecast.

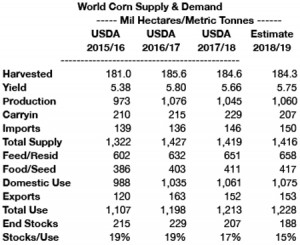

- March corn ended marginally higher and thus settled above its 50-day moving average. Argentina has been dry all season, but increasingly the establishment of La Niña looks to maintain dryness and mild heat through pollination. The two-week forecast lacks meaningful rain, and climate work suggests coming dryness is likely to extend into early February. Early planted corn in Argentina is rated at just 11% good/excellent. Even later planted corn is pegged at a disappointing 12% good/excellent. Yield loss is near certain as the crop pushes through reproduction. World grain prices also continue to move upwards; Black Sea feed wheat is offered at a new seasonal high $184/mt. In addition, somewhat surprising is the recent surge in Black Sea corn basis, from $.65 over futures to $.85 at the close of the week. US Gulf corn is still the world’s cheapest origin, and amid delayed crop development in Argentina should remain so into the middle part of spring. New bearish news is needed to push March below $3.45.

- Weekly US export sales of everything but wheat were at or above expectations, and through the week ending January 11 the US sold a meager 6 million bu. This is double the previous week, but still well short of the pace needed to hit the USDA’s annual export target. Sales have failed to meet the pace required for three consecutive weeks. EU prices have also declined in an effort to find better export demand and rid the market of excess stocks. Competition for world market share remains steep, and will likely remain so into the middle part of 2018. However, Russian fob offers have rallied to $194/mt, vs. $192/mt a week ago, and so further downside risk in EU cash prices appears limited. As the world’s wheat benchmark price rises, and as minor feedgrain prices remain lofty, the US too will find better consumption on breaks. Longer term, the next major driver of price will hinge upon whether N Hemisphere exportable surpluses rise or fall. In the near term, it is key that the US$ holds at 90 points on the Index; otherwise additional short covering is expected.