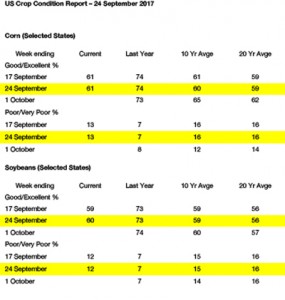

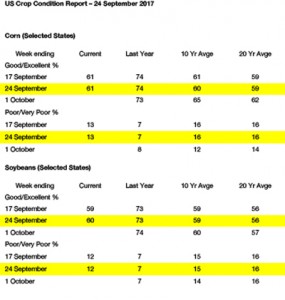

- US crop condition data has been released as follows:

- Following lower overnight trade, the soybean market continued lower in a mix of technical trading and selling in the soybean oil market. The EPA on Tuesday said that it will seek comments on potential reductions to both biodiesel and the advanced biofuel RFS targets for 2018, as well as biodiesel targets for 2019. Comments will be accepted for 15 days, with the 2019 targets to be announced on November 30th. While the impacts of such a decision are more months/years away, soybean oil futures sank as the news moved through the trade. The impact of reduced biodiesel imports has yet to be realised in either B100 prices or producer margins. In fact, since the Commerce Dept. implemented taxes on Argentine biodiesel, both B100 price and production margins have turned lower as the spread between soybean oil and B100 has narrowed. Nearby support ahead of Friday’s stocks report is expected under $9.60, while strong rallies will struggle against harvest pressure.

NOTE - Biodiesel is diesel fuel made from vegetable oils, animal fats, or recycled restaurant greases. It’s safe, biodegradable, and produces less air pollutants than petroleum-based diesel. Biodiesel can be used in its pure form (B100) or blended with petroleum diesel. Common blends include B2 (2% biodiesel), B5, and B20.

- The EU and GFS weather models continue to pull a Brazilian pattern change further into the nearby time period, and confidence is rising with respect to soil moisture being replenished in Central Brazil over the next ten days. The US$ has recovered well from early September’s low, and we would mention that US interior basis has been in retreat as bins are cleared ahead of harvest. Fresh yield data this week has not been overly shocking, and so NASS’s September yield figure is likely within 1-3 bushels/acre of final. The trade’s average guess on Sep 1 stocks rests at 2,350 million bu, exactly what the USDA printed in the last WASDE. Fireworks are not anticipated on Friday. The EPA announced today it is seeking comments on a potential cut to the RFS mandate in 2017 and beyond. This mostly affects biodiesel, as ethanol is left more to the free market, and we would also note that gasoline’s premium to ethanol is again rising, and production margins remain stout. Note, too, that Brazilian ethanol’s premium to US origin is rising, and this week nearly matches the 20% tariff put on imports of US ethanol this summer. We expect the US ethanol market to remain strong. Otherwise there is just not a lot of fresh input. Chart-based support rests at $3.45.

- US wheat futures ended marginally lower, EU and Black Sea cash prices are unchanged, overall the wheat market was rather listless today. We do highlight the recent bounce in spring wheat’s premium to other classes this week. NASS’s final wheat production estimate is due on Friday, and though yield was stabilised during the final throes of summer, it is abandonment that will push US HRS production 15-25 million bu lower, thereby pushing HRS end stocks closer to 120-125 million bu. We doubt much downside risk is left in the spring wheat market, as there is little doubt hefty premiums are needed to ration supply. World wheat price trends are noticeably positive in the Sep-Nov quarter, made evident by the recent rally in Black Sea fob offers, and so spot Minneapolis should find lasting fair value at $6.30-6.80, basis December. Australian forecasts lack any substantial moisture relief into Oct 5th, and a close eye wil needl be kept on continued rainfall in Argentina.