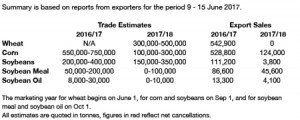

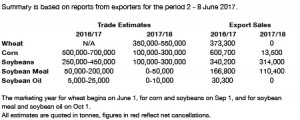

- US crop condition data has been released as follows:

- In a quiet start to the week soybeans ended a couple of cents higher, products were mixed as meal firmer and oil a round unchanged. After trading closed, NASS reported that 66% of the soybean crop was rated good/excellent, down one point week on week. It is likely that weather that will drive prices more than any other influencing factor as we head into late summer.

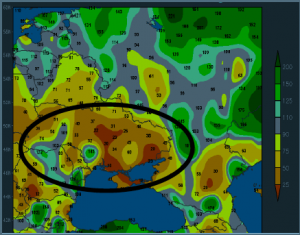

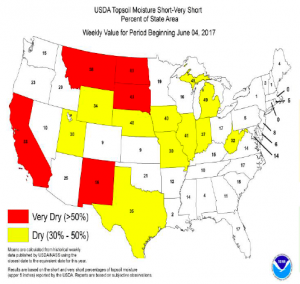

- Corn futures ended a touch higher on correction of technically oversold conditions. Weather models are in pretty good agreement that a high pressure ridge will extend into the heart of the corn belt bringing heat with it, the duration of this ridge is questionable at this time. Corn crop condition remained unchanged as far as the proportion rated good/excellent is concerned, perhaps the crop is stabilising at this time on the back of recent wetter and cooler conditions. Ukraine, on the other hand, remains dry with little in the way of precipitation in the coning ten days, which is following a June pattern that sits at somewhere between 20 and 40% of normal precipitation so far. Mid-July sees the crucial pollination period in Black Sea regions and current weather conditions will need to change in order to prevent further potential crop losses. We caution against a bearish stance.

- US spring wheat rallied to fresh highs on further dry weather conditions as modest selling resumed whilst fund short covering continued at a more robust pace than expected.Funds are no longer excessively short, which may well give something of a pause to stronger rallies. However, it should be noted that global weather remains less than ideal, our main area of concern being hot and dry conditions across the Black Sea regions. US spring wheat condition continues to fall with 41% now rated good/excellent, a record low at this time of year, and further downgrades are probable in the face of lack of precipitation. French soft wheat condition fell to 68% good/excellent as of June 19, prior to last week’s hot conditions, this is below previous year ratings.

- Clearly weather conditions are dominating at present.