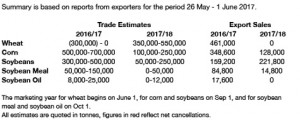

- Egypt’s GASC made a 360,000 mt purchase of wheat over the weekend with prices up $3/mt from their first tender of the season reflecting a general increase in global prices. Romania and `Russia were once again the awardees in this latest tender. Some feel that the price paid reflected something of a premium as a consequence of zero tolerance on ergot contamination – once again.

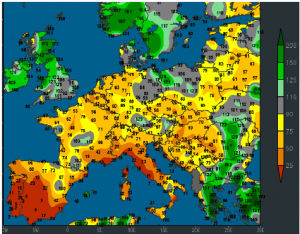

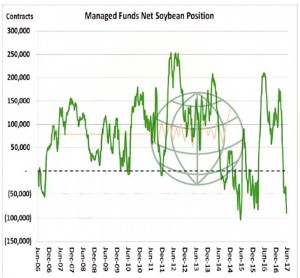

- Chicago markets have seen some decline today as forecast rainfall and its impact upon new crop corn and soybeans weighs on traders minds. Farmer selling has declined, perhaps as a result of declining crop condition. Fund managers are seeing prices fall back to last week’s breakout levels and a “Turnaround Tuesday” looks on the cards tomorrow. Historically dry conditions in the first half of June leave crops requiring abundant rainfall in the latter half of the month.

- Our view is that weather concerns are not yet over and that we will see further weather driven price rallies before this growing season is done and dusted. Trendline yields, particularly in corn, and also in US wheat, look ambitious at this time.