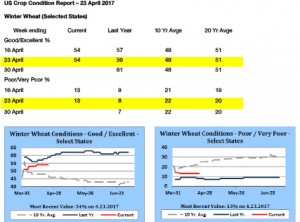

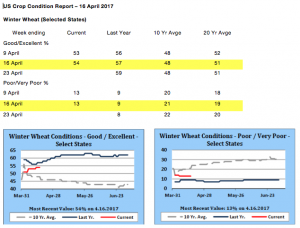

- There has been zero trades in London or Paris today due to the May 1 public holiday, which saw markets closed. However, this was not the case in the US where markets have been sharply higher as funds covered short positions. Kansas wheat futures led the way and have made a technical trend reversal as the market debates how much crop will be lost to disease, frost, and freeze ramp up. Snow cover across SE, CO, W KS and the OK panhandle is masking the extent of any damage, and this will remain uncertain until it melts. Today’s wheat condition report is expected to show some downgrade.

- US corn seeding to last Sunday is expected to reach 31% vs. 45% last year and an average of 30%. Soybean planting is estimated at 12% vs. 6% on average whilst spring wheat is estimated at 33% vs. 54% last year and 39% on average. Clearly the year on year lag makes May weather all the more important for catching up on both planting and establishment, and this will be watched closely.

- Informa Economics will provide its updated new crop US and world supply and demand estimates on Wednesday morning. Survey-based US winter wheat production will also be released, and the trade’s issue now is that freeze damage is somewhat tough to assess. On the margin, yield potential is in retreat, however, mostly due to the weight of snow on plants in the far W Plains. Daily updates from the KS wheat tour will be of particular interest. The US weather forecast ahead maintains a lengthy period of dryness, along with warming temperatures, but whether widespread precipitation returns in mid-May is less certain. We do note that the European/Black Sea forecast is improving. Rainfall worth .40-.80” was spread across France, Germany, Poland and parts of Ukraine on the weekend. Additional rain is indicated in W Europe over the next 5-7 days, and there remain hints of widespread soaking precipitation across much of the Black Sea in the May 7-12 window. Keep in mind that longer term price direction hinges upon the sum of major exporters’ balance sheets, rather than just the US.

- Despite the recent weather issues, the broad, longer term story of record global grain and soybean supplies is little changed, but the question now is to what extend funds aim to pare back short positions. Additional buying/short covering is expected on the close today, and follow through purchases early Tuesday (or not) will be critical to price direction over the remainder of the week.