- HEADLINES: Chicago trades lower with wetter midday forecast; Key support in Dec corn below $5.20 and November soybeans below $13.

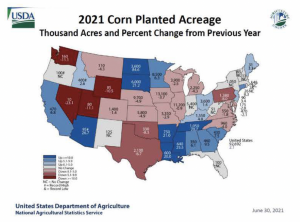

- Chicago futures are lower at midday with soybeans/soyoil the upside leaders with wheat/corn in decline. The CONAB Brazilian corn production estimate of 93 million mt was above private estimates, but in line with expectations. Rain is forecast to drop across Iowa on the weekend, but so far this week’s rainfall for the N Plains and the Upper Midwest has been disappointing. The weekly drought monitor portrayed a deepening drought across the Northern Plains and the Western Midwest. The dire nature of the W Midwest/Northern Plains drought implies that regular rainfall will be required through the remainder of the crop year. And with corn pollinating in the area, the number of rows around the cob may be compromised. We doubt that corn/soy/wheat futures have a lot of additional downside price potential with next price move determined by whether a high-pressure ridge setting up across the lntermountain West adds to existing drought conditions across the N Plains and W Midwest. The record large US corn yield is 176.6 bushels/acre, you do not make record yields without all primary Central US crop areas enjoying a favourable summer growing season.

- Chicago brokers estimate that funds have sold 3,200 contracts of corn and 2,100 contracts of soybeans, while buying 1,400 contract of Chicago wheat.

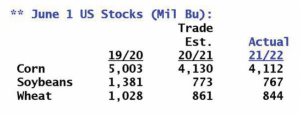

- Cash premiums for old crop corn/soybeans are firming (again) on tightening supplies and the need for quality. As farmers sweep the bottom of their bins, they are running into more off quality corn and soybeans. The ongoing strong US corn export program demands additional quality corn to fulfil Chinese purchases. There could be a spike or final push in cash corn and soybean basis in coming weeks unless the cash pipeline is able to uncover greater supply.

- CONAB admitted that its Brazilian corn production estimate at 93 million mt is from field data that is 20 or more days old. This means that none of the frost/freeze damage of last week was in the total, and the sharp falloff in recent harvested corn yield in Mato Grosso/Goias from late seedings was also missed. We currently stand by a final Brazilian corn estimate of 84-86 million mt in September as additional harvest data is available.

- US weekly ethanol production was record large for initial week in July and was 2% above 2019. And US ethanol stocks fell to 885 million gallons, which is up 2% on last year. Americans consumed a record amount of gasoline over the July 4 holiday. The US ethanol weekly production total to validate the USADA is 294 million gallons/week. This past week, the US produced 314 million gallons which consumed an extra 7 million bu of corn. The USDA 2020/21 US corn grind estimate remains too low by 45-65 million bu.

- The midday GFS weather forecast i s wetter in Eastern Iowa this weekend but is otherwise consistent with prior output. Steady rain arrives to the Central Midwest beginning Friday and persists into Monday, with accumulation of 1-3″ to be spread across the entirety of Iowa, Illinois and Ohio. The midday GFS forecast also indicates a secondary system across Central and Eastern Midwest next Thurs-Sun, which produces similar totals across Missouri, Illinois and Indiana. The Eastern Midwest will not be wanting for water into late month, though low-level flooding remains an issue in pocket of IL/IN. Net soil moisture loss resumes across the Plains and Minnesota. Record corn/soy yield remain unlikely.

- The market’s exclusive focus on rainfall continues into August. The pace that newly harvested crops are used determines fair value in autumn/winter. Our thesis remains that production fails to match consumption in 2021 amid historic Brazilian corn yield loss and the return of Chinese soy demand in bulk beginning late summer.