- The US has issued its weekly export numbers as follows:

Wheat; 1,674,600 mt, which is above estimates of 130,000-825,000 mt.

Corn; 417,200 mt, which is within estimates of 200,000-750,000 mt.

Soybeans; 566,800 mt, which is within estimates of 150,000-1 million mt.

Soybean meal; 315,200 mt, which is within estimates of50,000-425,000 mt.

Soybean oil; 8,200 mt, which is within estimates of zero to 15,000 mt.

- The surprise figure has to be wheat at more than double the top estimate, but the number did little to trigger any bullishness within the market. The cumulative export figures leave soybeans within 100,000 mt of the USDA’s full crop year figure. Given delays in Brazilian ports and Argentine soybeans proving to be uncompetitive, it would seem that the pressure on US soybean stocks will remain, at least for the time being. Meal exports remain similarly ahead and this will ensure pressure remains on the crush, and in turn on soybean supplies. The remainder of this season is shaping up to be extremely interesting!

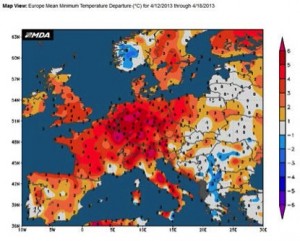

- Stratégie Grains have lowered their latest EU 2013/14 wheat output figure, for the fourth consecutive month, by ½million mt to 131.06 million mt with the UK contribution reduced yet again, this time by 330,000 mt. The conditions in the autumn were, as we have previously mentioned, dreadful and this left around 25% of the winter crop unplanted. The much publicised weather so far this year has done little, if anything, to aid the development of what was planted, and has delayed spring crop planting too. The figure for UK wheat was put at 11.78 million mt, the lowest in 12 years. Without doubt the weather is now the key determinant of final output; good or bad will affect the numbers correspondingly. Many are erring on the side of caution with the UK trade probably closer to 11 million mt at this moment in time.

- In the same report EU spring barley hopes for 2013/14 have also been hit following delayed plantings with output forecast at 29.29 million mt, a full 2 million mt behind last year. Total EU 2013/14 barley output, which is projected at 54.22 million mt is just over ½million mt behind last year. Interestingly the UK barley crop is forecast at close to 1 million mt above last year with a total output projected at 6.48 million mt, of which 1¼million mt is scheduled to be from spring planted crops.