Weekly CCI Analysis:

The CCI/CRB index finished the week lower even with a fall in the US$ on sliding grain and energy prices. The week ahead will be important as fund managers head into the end of the month and quarter. Amid US and Asian equity prices that are pushing to new record highs, commodities as an investment continue to fall out of favour. The recent rally in the CCI index appears to be corrective in nature and the US$ should rally regardless of the outcome of the Greek debt payment which is due on June 30th. At a minimum, the CCI index should retest contract lows by late summer or early autumn. Our view continues to remain bearish commodities. The world energy market should have scored its seasonal high with WTI crude above $62. A lower close in the week ahead would be deemed bearish heading into July.

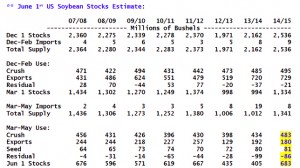

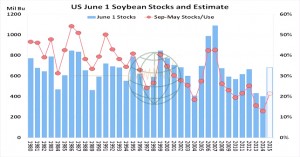

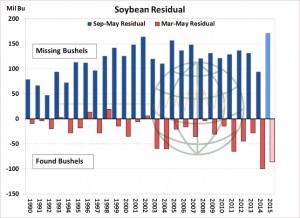

Longer-term soybean analysis:

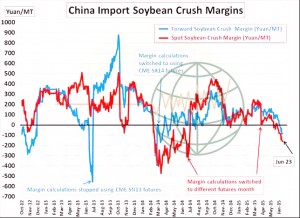

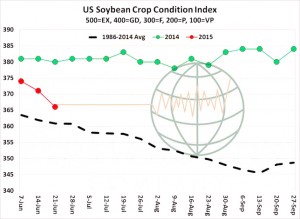

Soybean futures ended the week higher with fund short covering ahead of the end of month USDA reports being the main feature through the week. New crop soybeans fell to new contract lows which could not be sustained. This triggered short covering and a technical rally unfolded for the remainder of the week. The market is concerned that excessive rains in some areas of the country will reduce total acres. However, planting progress is expected to surpass 90% by Sunday, while crop condition ratings are expected to hold at a historically high level. Old crop June 1 stocks are projected at an 8 year high, and our view remains bearish. Saturday’s weather forecasts are much improved for the seeding states of KS and MO. A lower start is expected on Sunday with a resumption of the bear trend expected as US crushers added 2-3 weeks of cash inventory and have covered their crush needs into early to mid August. A cash lead decline is in the making.

Longer-term corn analysis:

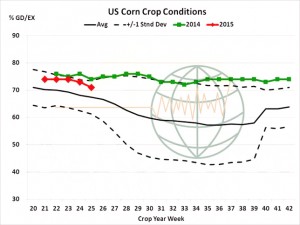

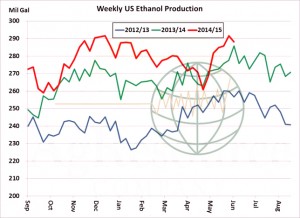

Corn futures this week ended unchanged. Strength was noted early, but US favourable longer term weather forecasts continue to trump uncertainty ahead of NASS’s Stocks and Seedings report. Heat/dryness is noted across the Delta/Southeast, with modest yield loss likely. But this will be offset by near record high crop ratings across the Central Corn Belt. NOAA projects July to be cool/wet across the whole of the Central US – driven by El Niño – and the trade is well aware of the positive effect cooler than normal temperatures have on Midwestern ear weights. Some weather premium was added early in the week, but potential for record/near record yields remain. Otherwise, little has changed. Gulf corn becomes uncompetitive beyond July. Black Sea weather is improving. June 1st stocks are projected some 850 larger million bu than last year. We maintain spot and new crop futures will drift slowly lower if favourable weather is confirmed beyond July 1.

Longer-term wheat analysis:

Wheat futures ended down 15-23 cents, with HRW contracts pacing the decline amid favorable S and C Plains harvest weather projected into the end of June. Much of Western and Central Europe has benefited from needed rainfall in the last 5-7 days, while Australia – despite El Niño – has seen soaking rainfall in the East, with similarly heavy rains offered to Western Australia in the coming days. With funds having liquidated a sizeable portion of their net short position in mid-June, it’s back to fine-tuning world production figures and determining just how much the Black Sea will export in the next 4- 5 months. World fob price spreads have narrowed, but a range of $4.50- 4.70, basis spot Chicago, is needed for Gulf SRW to compete against Russian and EU origins. US HRW is still a long ways off from finding any non-traditional business. Seasonal lows lie in the offing, but rallies will be hard-fought without extreme heat/dryness across Argentina and Australia in Aug/Sept. Rallies to $5.30-5.40, basis Chicago, are opportunities to catch up on 2015 and 2016 forward sales or to open/add to short positions.