Weekly CCI Analysis:

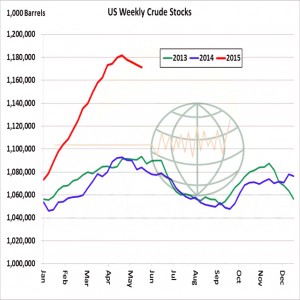

A sharp rally in the value of the US$ and weak economic data from China continues to weigh on world raw material values. The weekly CCI/CRB index finished little changed on the week amid a late week rally in crude oil bringing the CCI index to a slightly positive close. However, as the chart below reflects, the CCI is in a technical position of needing to rise above the late May highs for a new bullish trend to emerge. We expect that the Fed will raise US interest rates starting in September. This will help to spur further gains in the US$. Greece’s deferral on payment until June 30th only delays and potentially worsens their financial plight. Seems they have just “kicked the tin along the road” one more time! Our bullish view of the US$ is likely to keep pressure on commodity prices well into late 2015.

Longer-term soybean analysis:

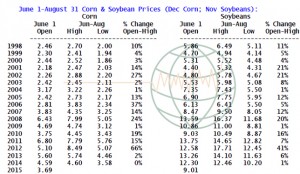

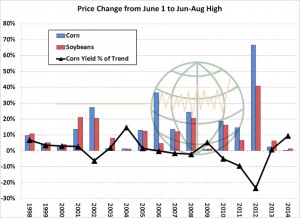

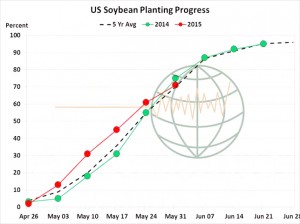

Soybean futures ended the week higher in both old and new crop contracts on short covering ahead of the June WASDE report. Cash prices also improved slightly through the week, but are more than $5 cheaper than a year ago with June 1st stocks estimated at multi-year highs. NASS will release its initial soybean crop conditions on Monday and good/excellent ratings are expected to be above 70%. Early growing conditions are favourable and the forecast offered into late June looks good. Trend or better yields look reasonable at this time, with many in the trade looking at yield potential of 46- 48 bu/acre. This along with expectations of larger US soy seeding in the June acreage report will produce a sizeable increase in the 2015 carryout. Our 2015/16 US end stock estimate is above 600 million bu. Our initial downside price target rests at $8.40-8.60 midsummer with the potential of sub $8 at harvest. Sell rallies above $9.30 November in coming weeks as $1.30-1.50 of weather risk does not seem needed or indeed justified at this time.

Longer-term corn analysis:

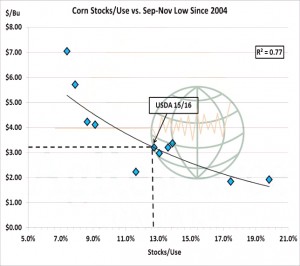

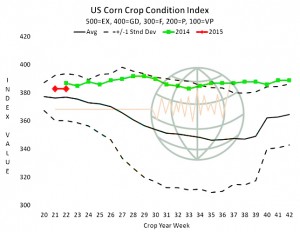

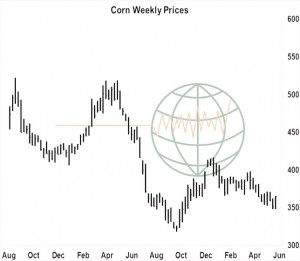

Corn futures bounced from contract lows and settled 9-10 cents higher. Slow planting is noted across parts of the SW Midwest, while short term weather concerns are cited in Western Europe. The longer term outlook, however, remains bearish. Lofty Gulf fob premiums are noticeably curtailing new crop US exports, and NOAA’s extended weather models now peak into the opening days of July, and normal precipitation and normal temperatures will be a feature over the next four weeks. China continues to have issues with its bulging feedgrain inventories. US corn is the world’s cheapest through the next 30 days, but South American fob offers plunge in July and beyond – and US new crop sales are down 24% from last year. A seasonal slowdown in ethanol production is expected beyond late June, and vegetation health maps indicate conditions much better than last year across the C Plains, Southeast, IA, MN, WI and IL. Summer rallies occur every year, but we expect this year’s bounce to be capped at $3.70, spot, and $3.90, Dec. Reward any short covering rally with sales.

Longer-term wheat analysis:

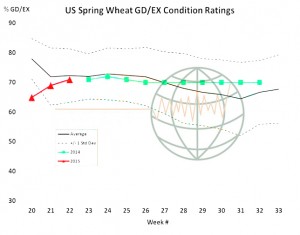

Wheat futures ended higher this week with Chicago contracts gaining 35-40 cents. The US$ spent much of the week lower, while short term dryness concerns linger in Canada and Western Europe. The funds have been swinging wildly between adding and covering short positions in Chicago. Extended forecasts maintain rain chances in Western Canada and Western Europe next week, along with favorably dry weather across the S Plains. If this forecast verifies, an intermediate high is being formed in US wheat. Our wheat outlook is little changed as bearish fundamentals remain intact. We’re unwilling to alter EU/Black Sea production estimates just yet, and uncompetitive fob offers (and another year lacking Brazilian and Chinese demand) is being felt in new crop US export sales. Our work suggests that the US$ remains longer term bullish as US job growth points toward a Fed rate hike sometime in late 2015. Critical N Hemisphere weather lies ahead, and so expect choppy trading into late June, but harvest progress and a surge in US end stocks will cap rallies at $5.40- 5.50, basis spot CME. Black Sea origin for Jul/Aug delivery is offered at prices equal to $4.60.