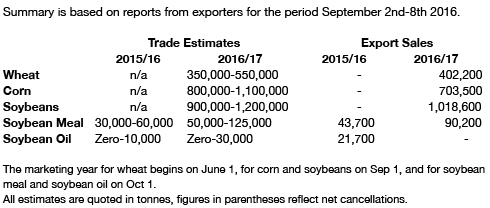

- The USDA has today released its weekly export figures as detailed below:

Wheat: 594,100 mt, which is within estimates of 300,000-600,000 mt.

Corn: 1,464,500 mt, which is above estimates of 600,000-1,250,000 mt.

Soybeans: 1,119,600 mt, which is within estimates of 950,000-1,800,000 mt.

Soybean Meal: 177,600 mt, which is within estimates of 75,000-325,000 mt.

Soybean Oil: 12,500 mt, which is within estimates of zero-50,000 mt.

- Brussels has issued weekly wheat export certificates totalling 581,266 mt, which brings the season total to 4.95 million mt. This is 1.28 million mt (34.9%) ahead of last year. Barley exports for the week reached 7,135 mt, which brings the season total to 982,118 mt, which is 1.62 million mt (62.3)% behind last year.

- Chicago markets have had little in the way of selling pressure today and fund short covering has produced something of a solid bounce, the first upward move of note in some time. End user covering was also noted at low prices but this appears to have eased as prices moved north. It is interesting that price support in corn futures now lies solidly at the $3.00/bu level, set at the time of the US meltdown in 2008 and early 2009!

- Seasonal price trends would have us looking for prices to rally, from harvest lows, into October as the N Hemisphere harvest draws to a close. Consequently we remain of the view that downside risk in the grains is low, and in soybeans the likelihood of a tradable bottom forming is growing. Our view is compounded by the size of the funds short positions, which (as we report on a regular basis) provides a potential springboard for prices to spike from.

- We await crop estimates from FC Stone and Informa Economics tomorrow and the market could well pick up on any overtly bearish (or bullish) input from these data releases.