- Our latest update on global wheat stocks can be downloaded by clicking on the link beow:

Major Exporter Wheat Stocks (Jan ’17)

- UK wheat premiums to feed barley remain at high levels, in the order of £21.00/mt on an ex farm basis. Whilst not creating records, there is a suggestion that the recent increase in poultry placings could add further pressure to the market. UK wheat prices look to remain well supported for the time being.

Soybeans: The threat in Argentina is shifting to dry, not wet and “normal” means down!

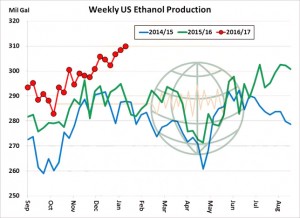

Corn: The trade sees growing concern with a big S American crop and weakness in ethanol markets.

Wheat: The US remains uncompetitive in global markets.

- Chicago markets have been lower today with under half an hour to go, soybeans easing to weekly lows and an early rally unable to be sustained on the back of weak US and S American cash markets. Volume has been poor in Chicago as traders tire of back and forth trade with little to show for it.

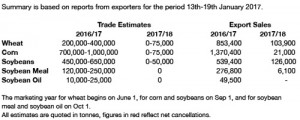

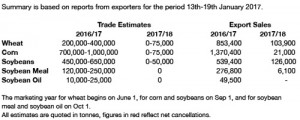

- US exports were reported as follows:

- Egypt’s GASC has tendered, once again, for wheat and at the time of writing there has been no announcement as far as awards are concerned; we will update accordingly in due course.