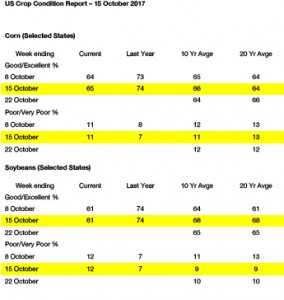

- US crop condition data has been released as follows:

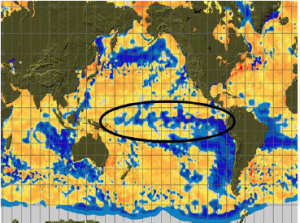

- La Niña is budding across the equatorial Pacific with the coolness pushing southward along the eastern coastline of S America. The rapid build of La Niña argues for heat/dryness across S Brazil and N Argentina during the mid to late crop growing cycle. The odds of a S American weather scare are elevated in La Niña years. The record warmth of world oceans argues against the La Niña episode continuing into mid 2018. If there is a crop impact, it’s likely to be S America.

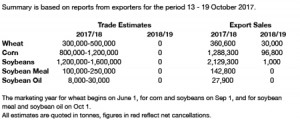

- Soybeans turned down at the morning open and November finished the day 2.5 cents lower on liquidation ahead of first notice day and a more favourable Brazilian weather forecast. After the close, NASS reported that through Sunday the US soybean harvest had reached 83% complete and was just under the 5 year average of 84%. LA is the first state to be 100% complete, but most of the Corbelt states are 80- 90% complete and winding down. Late season yield reports have quickly dropped and suggesting that the US yield could be another 1-2 bushels/acre lower by the January Crop Report. January soybeans have held an approximate range of $9.70-10 since September, and we look for that range to continue.

- Chicago corn futures ended steady to just fractionally higher, and still the market lacks direction. Work suggests that final US corn yield may be slightly understated yet, and export shipments continue to lag the pace needed to meet the USDA’s forecast. Black Sea feed wheat prices moved higher today, the pace of US harvest remains well below normal, and of course the speculative community already holds a rather sizeable net short position. We await input that would drive spot futures out of the long-established trading range. Harvest through Sunday reached 54% complete, vs. 72% on average, and progress is noticeably slow across the Dakotas, CO, IA, MN and NE, and we suspect that as more objective yield data is available, NASS will lift yield in November. Otherwise, we doubt a new bearish pattern can emerge without elevated farmer sales, which are not expected at current price levels, and we maintain a neutral outlook until S American crop enter critical growing phases.

- US wheat futures ended lower but in the middle of the day’s range, and highlighted today are a series of very aggressive tender results. Saudi Arabia bought 484,000 mt of optional origin wheat at $222/mt, which suggests exporters were willing to discount what appear to be replacements costs today, and which underscores that steep competition for new demand will be ongoing until Black Sea logistics cap exports there during the winter months. World cash milling prices are firm, but have been unwilling to move higher in recent weeks. The season’s first crop winter wheat crop rating (see above) was pegged at 52% good/excellent, vs. 58% last year and 55% on average. Ratings in the N Plains very bad (17% good/excellent in SD), but otherwise are pretty close to average. National ratings suggest trend yield and normal abandonment are intact. Like corn, we look for minimal changes in price in the near term, but a close eye will be need to be kept on recoveries in currencies in major exporting countries amid recent strength in crude prices. A bearish outlook is not advised here.